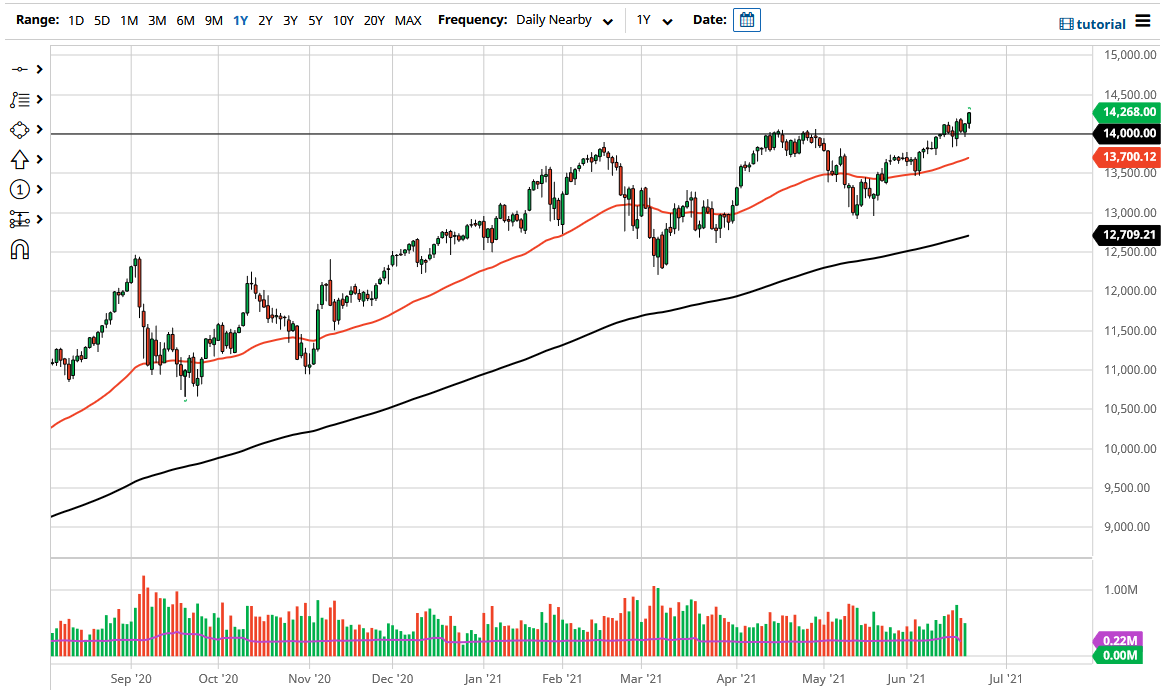

The NASDAQ 100 continues to show signs of strength as we have broken to all-time highs yet again. It appears that the technology growth stocks are back in favor again, and it is only a matter of time before we see this market reach towards the 14,500 level, and then eventually the 15,000 level. I have no interest in shorting this market and it now looks as if the 14,000 level will end up being a relatively significant floor in the market. Furthermore, we also have the 50-day EMA coming into the mix as well.

The NASDAQ 100 fell out of favor for what looked like about three minutes, and now it looks like we are ready to continue as we close at the very top of the range. That being said, I think that any pullback will be bought into aggressively as the Federal Reserve has become dovish enough to make people happy, with the markets now set for a measured move to the 15,000 level. I base this upon the ascending triangle or the rectangle that sits underneath, depending on how you look at the market.

Unless we see some type of major turnaround in the US dollar, it is very unlikely that the stock markets will fall, and now that we have gotten the Federal Reserve out of the way, it is very likely that we will go back to “business as usual” in this index right along with many others. Remember, the Federal Reserve’s number one job is to keep Wall Street happy, and they most certainly have done that over the last couple of days. We have seen the slightest hint of talk of tapering, which sent the markets into a tizzy. The Federal Reserve has learned that it is not okay to do that, so every time they attempt to look as if they are ready to tighten monetary policy, they have to ride right back to the rescue of a market that has no idea how to deal with normalized interest rates.

As long as that is the game we are playing, that is the game you must play. Remember, this has nothing to do with the economy, nor does it have anything to do with company valuations. That is how markets used to work, but now that we are algorithmically driven and have to pay attention to monetary flows, this is a market that you are only buying. This does not mean that you always have to be long of the market, just that the idea of shorting this market is a great way to blow up your account.