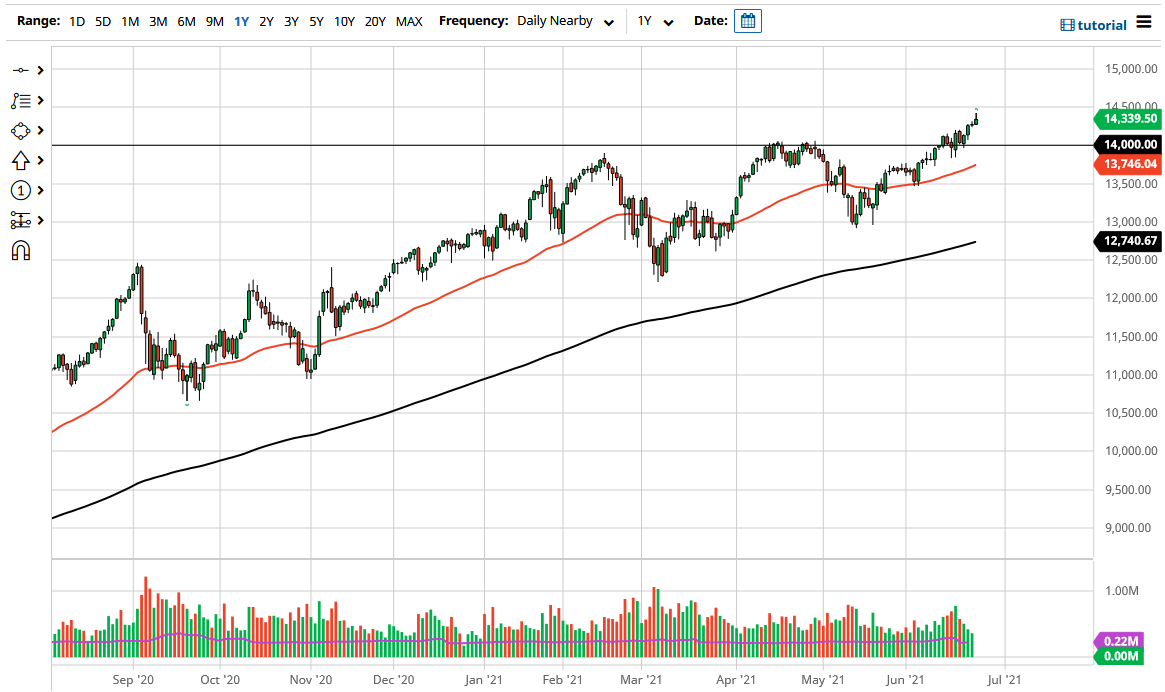

The NASDAQ 100 rallied during the trading session on Thursday to reach all-time highs again at the 14,425 region. We did pullback just a bit but at the end of the day we are still very bullish looking, and it looks like some of the bigger technology companies are starting to attract a lot of money again. If that is going to be the case, then it makes quite a bit of sense that we would see the market go much higher, perhaps reaching towards the 15,000 level which is my longer-term target.

Underneath, I see the 14,000 level is an area that would attract a lot of attention in the form of support, as it had previously been so resistive. Furthermore, the 50 day EMA is reaching towards that level so that should also backed up any type of pullback as far as support is concerned. As money rotates from value back into growth in the stock markets, it does make a certain amount of sense that the NASDAQ 100 would be one of the bigger beneficiaries.

Just like the S&P 500, I have no interest whatsoever in trying to short this market, due to the fact that it is manipulated just like other US indices by the Federal Reserve. After all, if stock markets fall enough, Jerome Powell will start talking about how dovish the Federal Reserve can be. With that in mind, I think that dips will continue to be buying opportunities, perhaps all the way down to the 13,000 level. It is not until we break down below the 200 day EMA, which is currently reaching towards that 13,000 level, that I would be thinking about becoming bearish. At that point, I would be a buyer of puts, because as you know you cannot short US indices for any real length of time, because all it would take is a couple of comments from the wrong person coming out of the Fed, and then the next thing you know you are down 15%. With this, I believe that the 14,000 level more than likely is going to offer a bit of a “floor the market” going forward and 15,000 is probably all but a foregone conclusion sometime over the next couple of months. We are in the summertime trading, so it does tend to be a little less exciting.