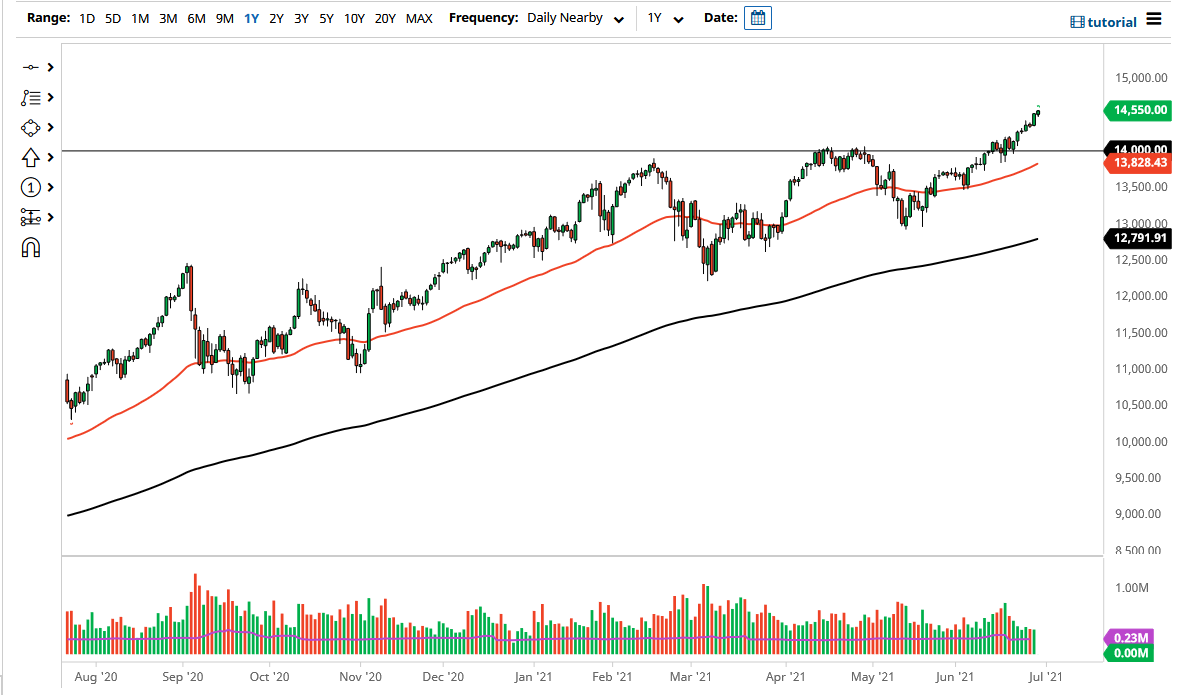

The NASDAQ 100 has rallied significantly during the course of the trading session again on Tuesday, as we have now taken out the 14,500 level quite handily, and it looks like we are ready to go much higher. The most obvious target would be the 15,000 level, which is the next large, round, psychologically significant figure, and therefore it will attract a certain amount of attention in and of itself. When you look at the chart, it makes no sense to short this market whatsoever, so I think that any time we pull back, there should be plenty of value hunters out there willing to take advantage of it.

The 14,000 level underneath I think is the “floor in the market” currently, as the 50 day EMA is reaching towards it. The 14,000 level is also the previous resistance barrier that the market has respected so much over the last several months, and now a certain amount of “market memory” could come into play in that general vicinity. As you can see, the market has been in a significant uptrend for quite some time, and therefore it is likely that we are going to continue that overall movement.

On Friday, we get the jobs number and that of course will cause a certain amount of volatility, but I think if we get some type of “knee-jerk reaction”, I would anticipate seeing plenty of buyers on that move. Furthermore, when you look at the NASDAQ 100, the usual suspects are the main drivers, meaning Facebook, Microsoft, Alphabet, Tesla, etc. Now that although stocks are back in vogue, it does make a certain amount of sense that the NASDAQ 100 will move rather quickly, and much higher as everybody is back into that “growth play.”

If we do break down a bit, I think that you will see the 13,500 level offer significant support, right along with the 13,000 level. The 13,000 level is currently being approached by the 200 day EMA, so for me that is going to be “bottom of the trend.” If we break down below there then we will need to see what happens next, but at best I would be a buyer of puts because shorting the US index is tantamount to burning money as the Federal Reserve will step in and verbally pick the market back up.