The NASDAQ 100 bounced during the trading session on Monday as the 14,000 level has offered support yet again. This is a market that looks as if it is ready to go higher, as the Federal Reserve will do everything it can to keep the market afloat, with the Federal Reserve chairman speaking in front of Congress during the session. That suggests that we will probably continue to see the potential for volatility, but at the end of the day I believe that Chairman Powell will more than likely do what the market wants, suggesting that the liquidity will continue to flow for as long as we can see.

In fact, the members of the Federal Reserve have already suggested that perhaps the market has gotten the idea of tightening wrong, as they are not looking at doing anything for at least two years. That being said, the market has turned around, and it suggests that we are ready to go much higher. If we make a move above the recent high, then it is likely that the market could go looking towards the 14,500 level. That is an area that will attract a certain amount of attention, but I think it is only transitory as far as interest is concerned, as the market is much more likely to pay close attention to the 15,000 level.

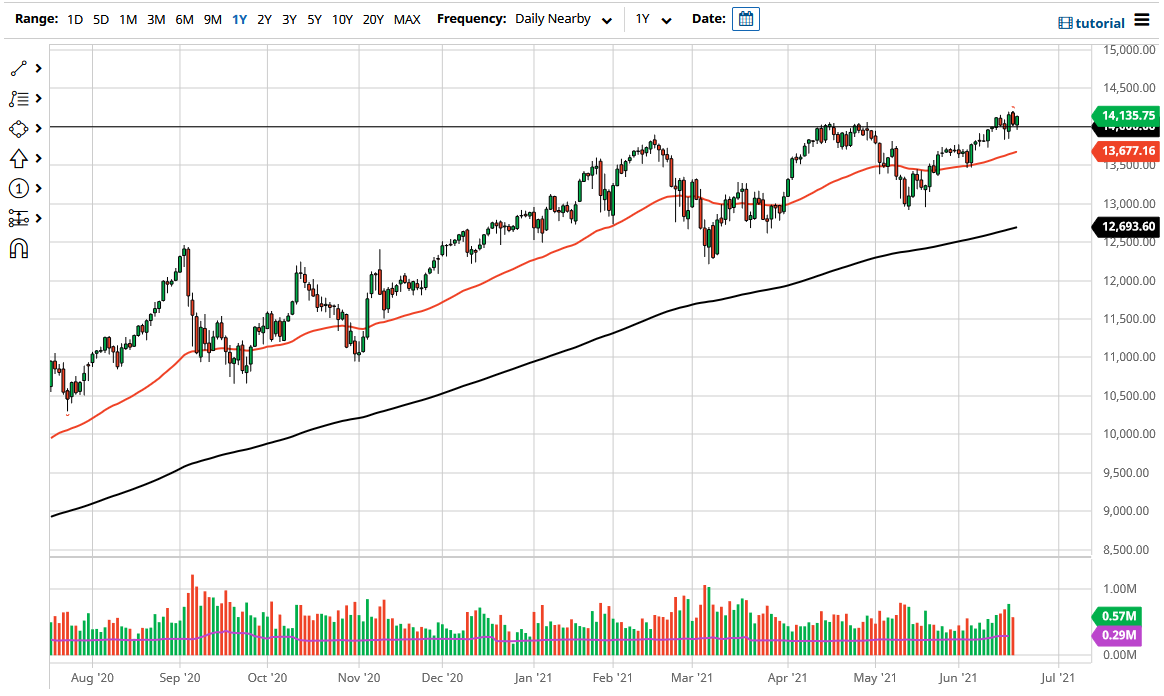

To the downside, the 50-day EMA sits at the 13,677 level and is sloping higher. The 50-day EMA is likely to offer a bit of support, and I think that buyers would come in there to pick up value, just as they would down to the 200-day EMA, which could very well dissect the 13,000 level by the time we get there. Nonetheless, I think that is very unlikely, and I have no interest in shorting this market. I believe that the NASDAQ 100 should continue to go higher, but if we did break down significantly below the 200-day EMA, then I might be a buyer of puts. Nonetheless, I think buying dips will continue to be what the rest of the market looks at as a potential play. We are in an uptrend, so trading against the index is not the way to go.