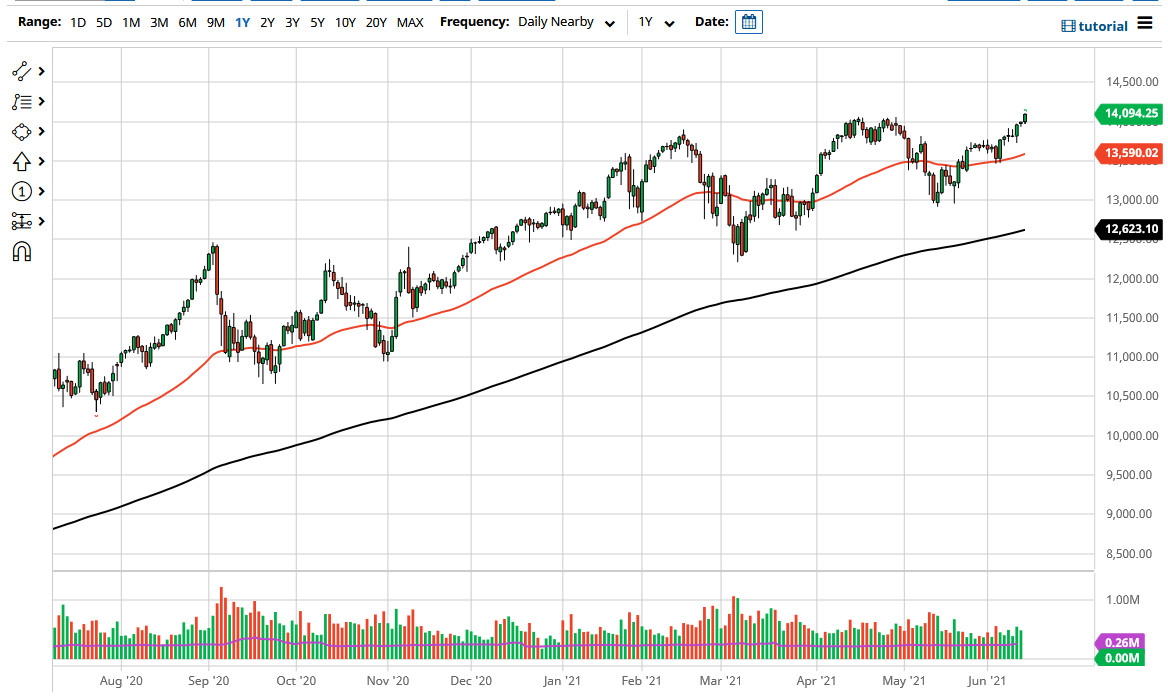

The NASDAQ 100 broke higher during the trading session on Monday to make a fresh, new high, as we continue to see more of a grind to the upside. What I find interesting is that the NASDAQ 100 has taken the lead again, as it had previously. After all, the NASDAQ 100 had been a bit over-stretched, but now it looks like we are comfortable going long again.

What is worth noting also is the fact that the narrative of “cyclical rotation” is starting to lean back towards large-cap growth companies, meaning that the NASDAQ 100 should do quite well. I believe that the NASDAQ 100 will take the lead again for a bigger move, perhaps reaching towards the 14,500 level. The 14,500 level is an area that will attract a certain amount of attention due to the fact that it is a “mid-century mark”, but regardless, I think that it is only a matter of time before we break through there as well, reaching towards the 15,000 level.

Underneath, if we were to break down below the 14,000 level, I think it is very likely that the 50-day EMA would come into the picture, which we also have support underneath at the 13,500 level. That is an area that has been supported recently, so it would not surprise me at all to see it act as such again. Further fueling the idea of this market going higher is the fact that we closed that the very top of the range, showing that we will more than likely continue to see plenty of continuation going forward. Ultimately, this is a market that I think looks very bullish and I do not believe there is an argument to be made for selling other than a quick scalping.

Given enough time, I think the NASDAQ 100 will start to focus on the idea of low inflation, because disinflation is probably more of an argument to be made than continued “sticky inflation” that some people are taking a look at. With this, I think that it is probably only a matter of time before dips can be bought into, and now for I think it is only a matter of time before you have to get long.