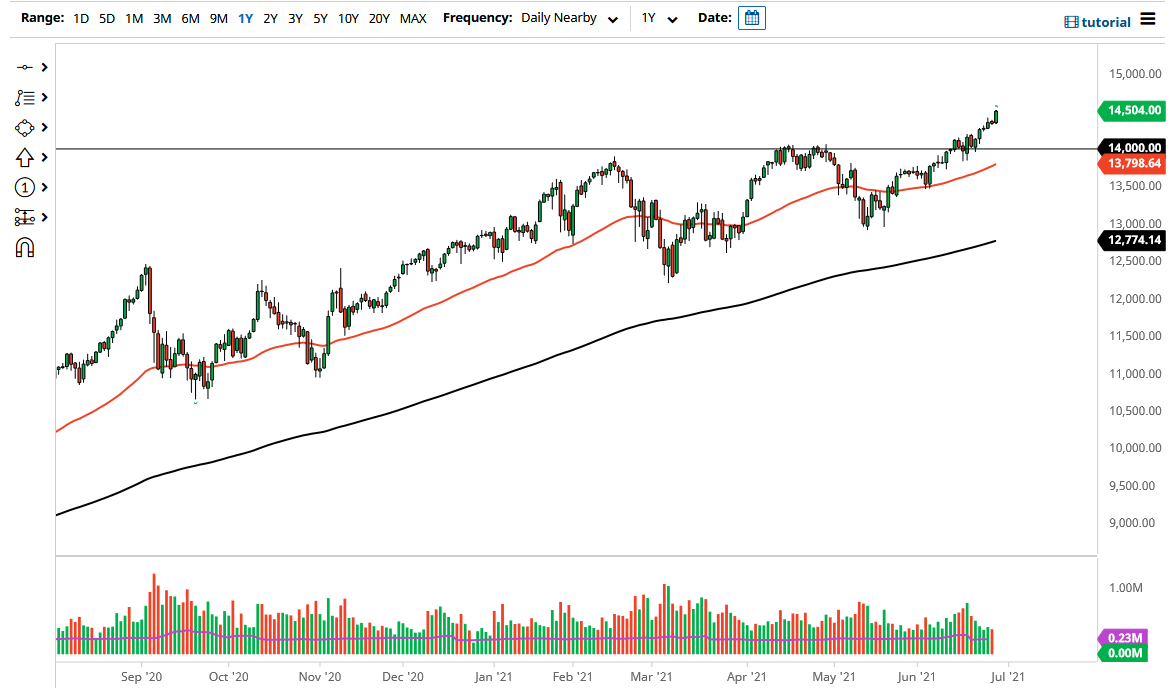

The NASDAQ 100 rallied rather significantly during the trading session on Monday to make fresh new highs yet again. In fact, we ended up conquering the 14,500 level, opening up the possibility of a move towards the 15,000 level. A pullback at this point should be thought of as a potential buying opportunity, and as a result, I think that in this market continues to be more or less a “buy on the dips” situation.

The 14,000 level underneath should continue to be a bit of a “floor in the market”, due to the fact that it was previously the resistance barrier and all-time high that had been so difficult to overcome. Add to the fact that the 50-day EMA is reaching towards that area, and it makes sense that we could see massive amounts of buying pressure in that general vicinity. This is a market that I have no interest in shorting, but even if we do break down below the 50-day EMA, it is likely that we could go looking towards the 13,000 level where the 200-day EMA is racing towards. That being said, I have no interest in shorting this market, but I would be a buyer of puts if we break down below the 50-day EMA.

This is a market that I think is much more likely to go higher than lower, and if it did break down, it would more than likely have something to do with some type of overall “risk off move”. It is worth noting that the NASDAQ selling off probably leads all indices in selling off. With that being said, the market is likely to continue to see a lot of bullish pressure, especially as the Federal Reserve is going to do everything they can to lift the market and will continue to do so as we have seen over the last 13 years or so. It is almost impossible to fight the central bank, and there is no point in doing so. With this being the case, I think that the handful of technology stocks that have the most influence on this market will continue to be major drivers of the market to the upside.