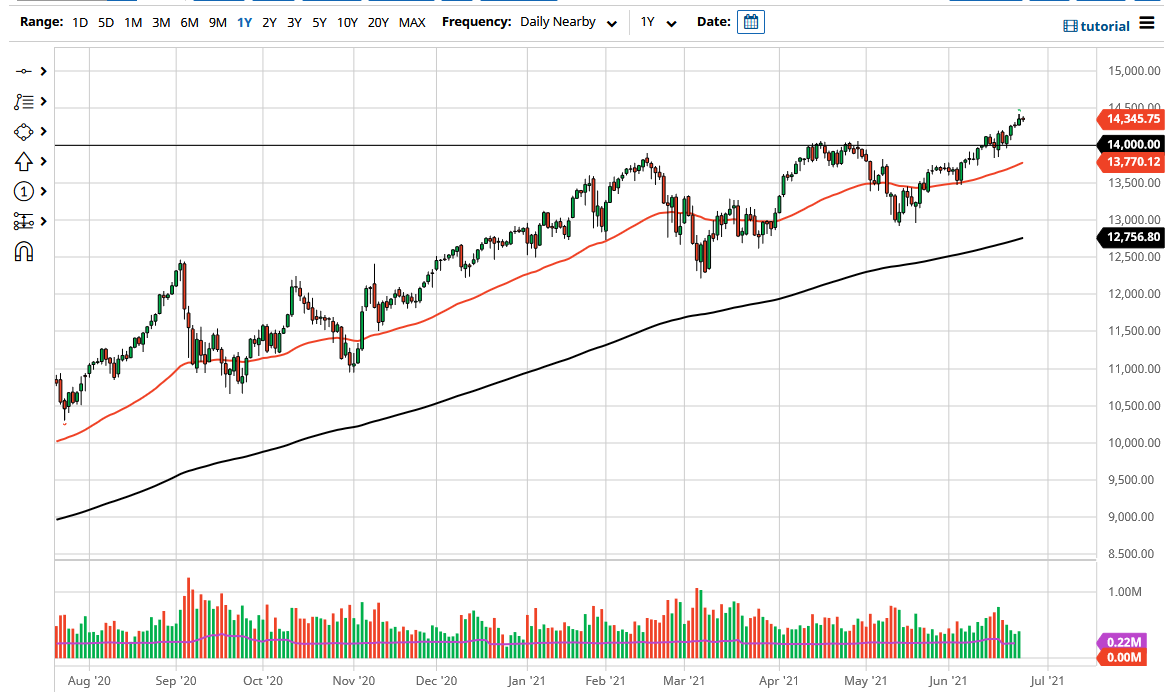

The NASDAQ 100 was somewhat quiet during the trading session on Friday, but it continues to look very bullish as we are challenging the 14,500 level. That is an area that I think will attract a certain amount of attention, but it is going to be much more important when we reach the 15,000 level as far as the psychology is concerned. To the downside, the 14,000 level was previous resistance, and it should now be significant support. This will be especially true as the 50-day EMA starts to reach towards the 14,000 level.

At this juncture, the NASDAQ 100 has led the way, and we have broken out of a major consolidation area. The recent action ended up forming a bit of an ascending triangle, and I think the “measured move” of 1000 points will go looking towards the 15,000 handle. One thing is for sure; we are in an uptrend, and it is likely that we are going to continue to see value hunters come in every time it dips.

That is, unless the Federal Reserve suddenly steps out of the “elevating the stock markets game”, or if for some reason there is a major breakdown in risk appetite. Ultimately, the 13,000 level underneath is starting to attract the 200-day EMA, so it is very likely that it will be the absolute “floor in the market.” If we were to break down below there, then I think the NASDAQ 100 will end up being in serious trouble. That being said, I have no interest in shorting this market anytime soon, and I think it is likely that we will continue to see plenty of jawboning by the Federal Reserve to keep the market elevated.

If we break down below the 50-day EMA, then it is possible that I might be a buyer of puts, but I would not be a seller due to the fact that anybody who has tried to short the market over the last couple of years has gotten absolutely crushed at the first hint of Federal Reserve influence. I believe that 15,000 is calling.