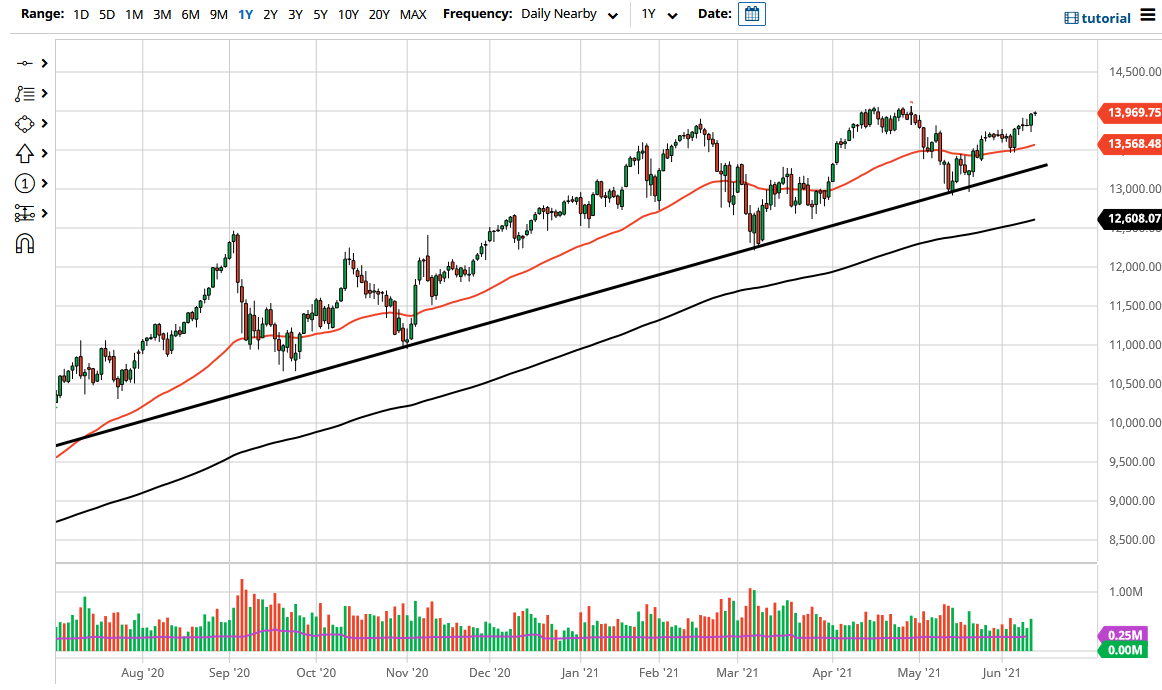

The NASDAQ 100 did very little during trading on Friday, but that is probably not a huge surprise as traders headed into the weekend and thinking about summer holiday more than putting money to work. That being said, we are sitting just below the 14,000 level, an area that has been a bit of a barrier recently. We are not that far from the all-time highs, so it is worth noting that the hesitation also makes a bit of sense as people will be looking for some type of indication that we could go higher and a catalyst to make it happen.

To the downside, I believe that the 13,750 level is short-term support, followed by the 50-day EMA which has been sliced through multiple times, but it is also an indicator that a lot of longer-term traders like to pay attention to. If we were to break down below there, then it is possible that we could go looking towards the uptrend line that sits just below. Having said that, I think any of these areas could offer a buying opportunity, given the right set of circumstances. That being said, the market is likely to see a lot of noise just below and a certain amount of value hunting, as the market has been very strong for quite some time. In fact, you can also make an argument for a bit of an ascending triangle being formed right now.

To the upside, if we can break out, then I think the next logical target would be the 14,500 level, followed by the 15,000 level which is my longer-term target. If interest rates continue to cool off, it is very possible that some of the big names in the NASDAQ will rally right along to reach higher levels. Ultimately, this is a market that I think continues to see buyers on dips and there is almost no way to short this market. In fact, if we did break down below the uptrend line, I think you could probably have a short-term put-buying opportunity in the options market, but that is about as bearish as I would get. Breaking down below the 200-day EMA could bring in a major flush lower, but that would only attract the attention of the Federal Reserve which tends to save the market if it has to.