The NASDAQ 100 initially tried to rally during the trading session on Wednesday but gave back the gains to drift ever so slightly lower. This is a market that has not been worth trading for a while, and I think that is going to continue to be the case, at least until we get the jobs figure on Friday at the very earliest. After all, a lot of traders out there are worried about the idea of inflation and the employment picture in the United States, as it is so heavily distorted by the “free money” that has been offered to anybody who did not want to work.

21 states have ended the federal employment boost, so it is very possible that people will have to get back to work rather soon. The question now is not so much as to whether or not there are going to be more workers, but whether or not it will be enough to satiate the demand for laborers. Because of this, the market is likely to pay close attention to the jobs figure, but at the end of the day, it will more than likely just be yet another opportunity to go higher.

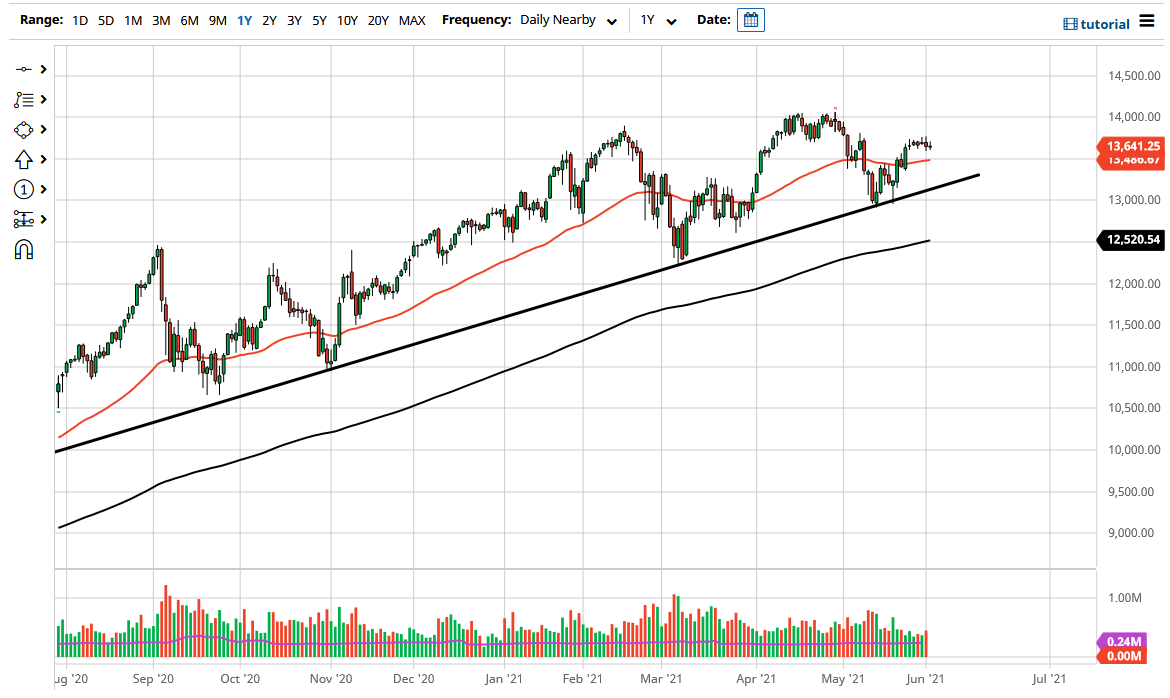

That being said, the market also sees the 14,000 level above as a major resistance barrier, so it is possible that we would see it offer quite a bit of selling pressure. But if we were to break above there, it is likely that the market could go looking towards much higher levels, probably the 14,500 level. I think that we are going to go looking towards the 15,000 level based upon the fact that we are in an uptrend and that liquidity continues to be a main driver.

Underneath, we have an uptrend line that has been followed quite nicely, and at this point it does not look overly threatened. Some people are ringing the alarm bells of a “lower high”, but they forget the fact that it is non-farm payroll week, so most traders are probably waiting for that announcement. In other words, we have had nowhere to be, and I do not necessarily think that that will change during the day on Thursday. If we did break down below the uptrend line, then I would be a buyer of puts, but I have no interest in shorting this market.