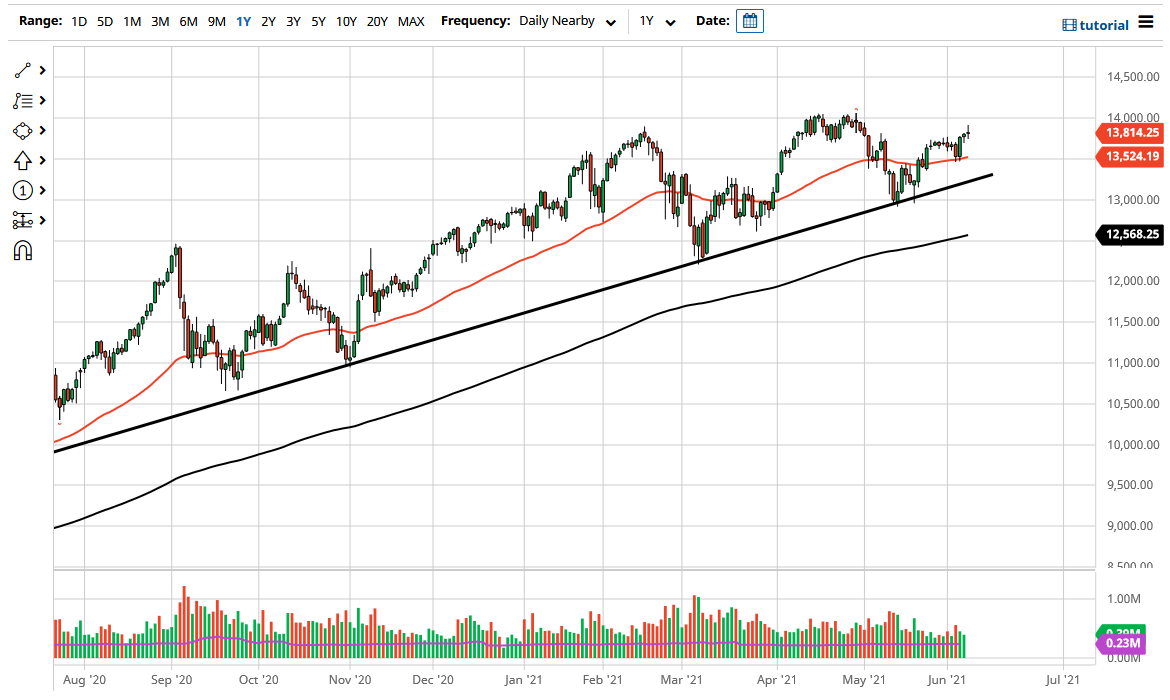

The NASDAQ 100 initially tried to rally during the trading session on Tuesday as we continue to see money flow into the marketplace. However, we could not hang on to the gains for the day and ended up forming a bit of a shooting star. While this is typically a negative sign, the reality is that I do not think that this market is going to fall apart anytime soon. More likely, we will see more of a grind sideways as a lot of traders out there are going away for the summer, and then the CPI figures come out on Thursday that could have people looking at the potential effects of inflation.

Nonetheless, the 50-day EMA sits right around the 13,500 level, and that should offer a little bit of a supportive balance just waiting to happen, and the fact that it sits at a “500 mark” also probably comes into play as well. Beyond that, we also have a nice uptrend line underneath that should continue to push this market to the upside. I think this is a market that continues to be a “buy on the dip” type of scenario, just as it has been over the last 13 years. With this being the case, I like the idea of buying these dips, as it continues to be very bullish.

Even if we break down below that uptrend line, I think that the 13,000 level underneath would be significantly supportive, and then the 200-day EMA. However, if we were to break down below that uptrend line, then it is likely that I would be buying puts in this market, but I would certainly not short it as the NASDAQ 100 is very sensitive to interest rates, which is in the focus of both the Federal Reserve and traders right now. There are a lot of questions when it comes to inflation, so we have to keep in mind that the market could be very volatile. Regardless, I think that there are plenty of value hunters out there willing to get involved. The 14,000 level above is a significant barrier, but if we break above that then I anticipate that this market will go looking towards the 15,000 level.