The NASDAQ 100 pulled back a bit during the trading session on Tuesday to show signs of exhaustion. At the end of the day, I suspect that the biggest thing here is that traders are trying to get flat ahead of the Federal Reserve announcement at the end of the session on Wednesday, as monetary policy will obviously have a huge effect on what happens next. With this being the case, the market is probably looking for reason to go long given enough time, but we are likely to see buyers based upon value.

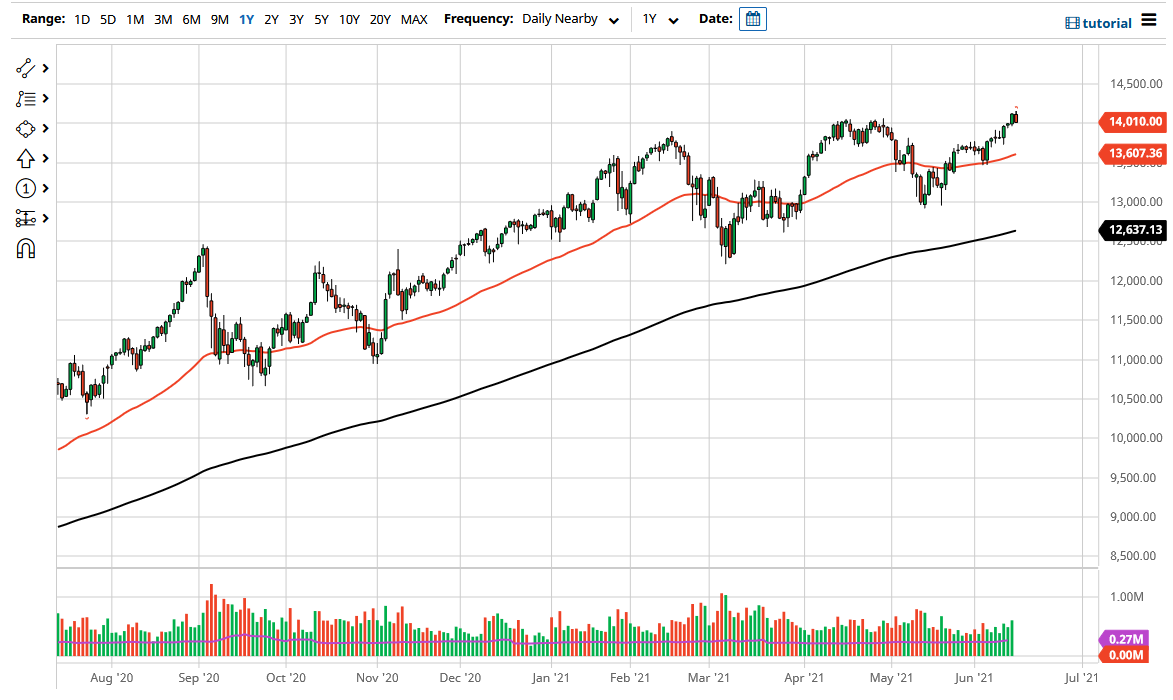

The 50-day EMA is sitting at 13,607 and is sloping higher. Ultimately, the 50-day EMA is somewhat supportive, but only from a directional standpoint. As you can see, the market pulling back has wiped out the gains from the previous session so you could make an argument that we have just formed a “48-hour shooting star”, but as I said, this is more or less market participants trying to get out of the way of the Fed announcement.

At this point, I think the only way this market truly breaks down for a bigger move is if the Federal Reserve suddenly suggests that they are going to taper, something that I would not expect to see during the session, especially as the retail sales were such a disaster earlier during the day. Because of this, the market is likely to continue to the overall trend, which has been rising for quite some time. In the short term, I believe that the market has plenty of support underneath, not only at the 50 day-EMA, but also the 13,500 level, possibly even the 13,000 level.

If we were to break down below the 13,000 level, I might consider buying puts at this point, but would not be a seller straight out due to the fact that the Federal Reserve will allow things to get out of hand. If you buy a put, you have the ability to control your risk overall, as a couple of words out of the Fed could send this market right back around. Remember, the Fed steps in to pick up Wall Street when it has to, and I would anticipate that would be the case on any type of significant breakdown.