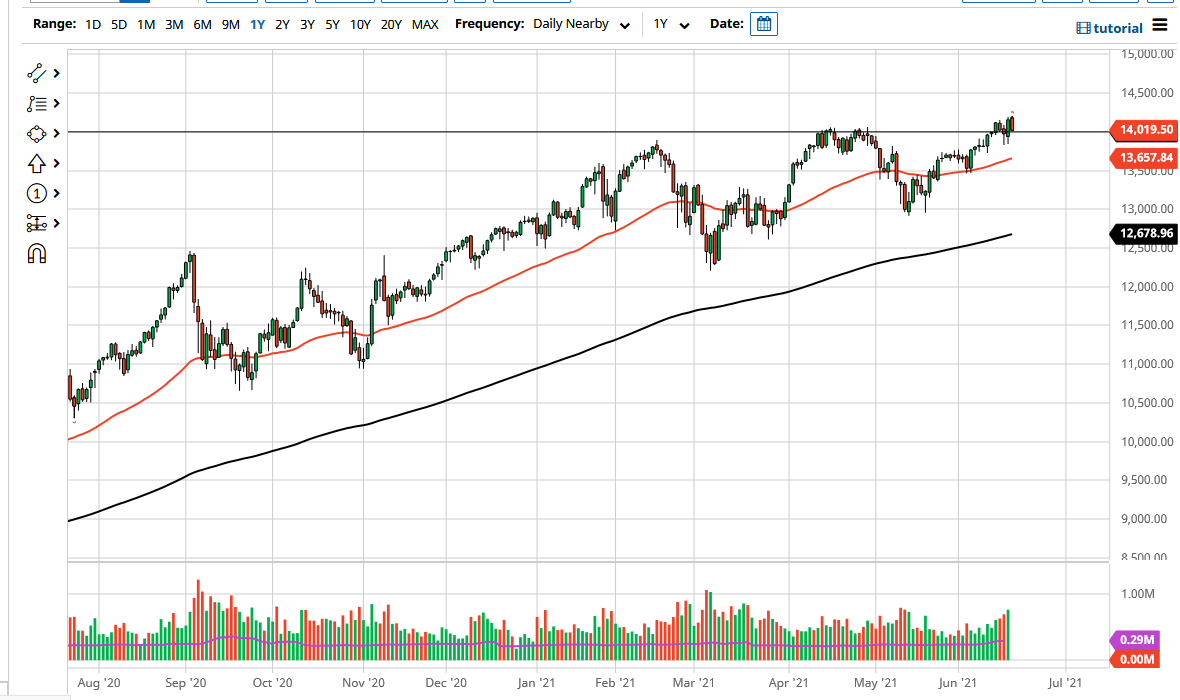

The NASDAQ 100 pulled back rather significantly during the trading session on Friday as we continue to see a lot of unease in the stock markets. That being said, we did stop at the 14,000 handle, which is a large, round, psychologically significant figure, but perhaps more importantly, it is also an area where we have seen the market react multiple times. The fact that we held this area is a good sign, and I think that it is only a matter of time before the buyers return.

We may have a little further to go to the downside, but the 50-day EMA comes into the picture at 13,650, and I do think that we will probably continue to see buyers on dips based upon value. After all, this market has outperformed the S&P 500, even after the Federal Reserve announcement. With that in mind, we are still very much in an uptrend, and you can even make an argument that we are simply testing the previous resistance to see if it will hold as support.

Based upon the ascending triangle that is sitting on the chart, you can also make an argument for a move towards the 15,000 level, and as soon as traders calm down a bit about the possibility of the Federal Reserve tightening in a year and ½, the more likely we are to see more bullish attitudes again.

There is also the very real possibility that someone from the Federal Reserve may come out and say something on Monday in order to calm things down a bit. That being said, the market is going to continue to see massive amounts of liquidity, so I think it is only a matter of time before stocks react the same way they always have, as the last 13 years have been all about how much the Fed is pumping things up. At this point, I have no interest in shorting this market anytime soon, so I am looking for the possibility of finding value. The question is whether or not we will start to rally right away on Monday, or if there will be an opportunity to buy the NASDAQ 100 at lower levels. Either way, I do believe that there is a buying opportunity coming rather soon.