The NASDAQ 100 fluctuated during the trading session on Tuesday as traders came back to work from the holiday weekend. Nonetheless, this is a market that is trying to figure out where to go next, and the trading session showed just how all over the place we could be. The NASDAQ 100 is moved by just a handful of companies, so you have to pay attention to all the usual suspects, which were all over the place during the trading session.

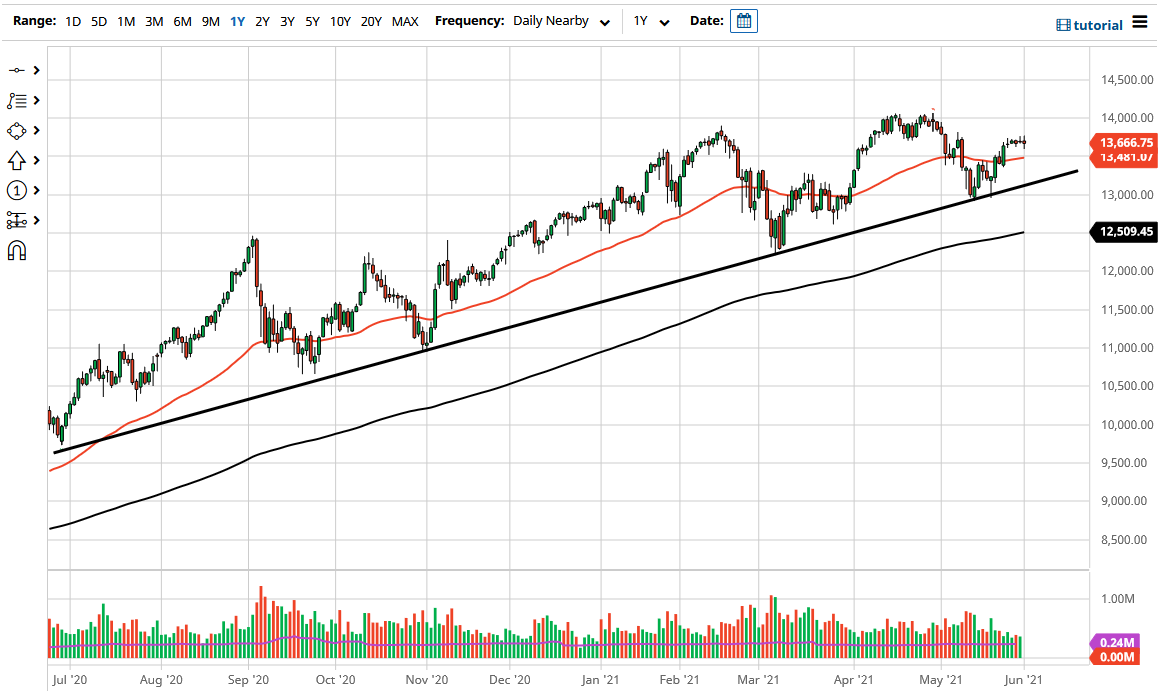

Underneath, the 50-day EMA will offer a certain amount of psychological support, especially as it is sitting right around the 13,500 level. Underneath there, the uptrend line is rising, which could provide a bit of support. To the upside, I believe that the 14,000 level is the short-term target, where we have seen a lot of selling. Nonetheless, if we can break above the 14,000 level, it is very likely that this market will continue to go much higher, reaching towards the 14,500 level, possibly even the 15,000 level after that. We have been in an uptrend for quite some time and are forming a major ascending triangle. That ascending triangle is something that I think everybody in the market notices, so I would not be surprised at all to see a bit of follow-through.

If we broke down below the uptrend line and reach towards the 13,000 level, then it is likely that we could go down to the 200-day EMA. If we were to break down below there, then I might be a buyer of puts, but I will not short the US index, because the Federal Reserve has been held hostage by Wall Street for at least the last 13 years meaning that every time there is a tantrum in the stock indices, the Federal Reserve will come out and apologize for whatever move they just made. Do not believe me? Do a little research and you will see how this has happened multitudes of times. This is a “long only market”, or probably a better way to put it is that you are either “long only” or sitting on the sidelines. Shorting the NASDAQ 100 can bring in some profits, but short-term at best.