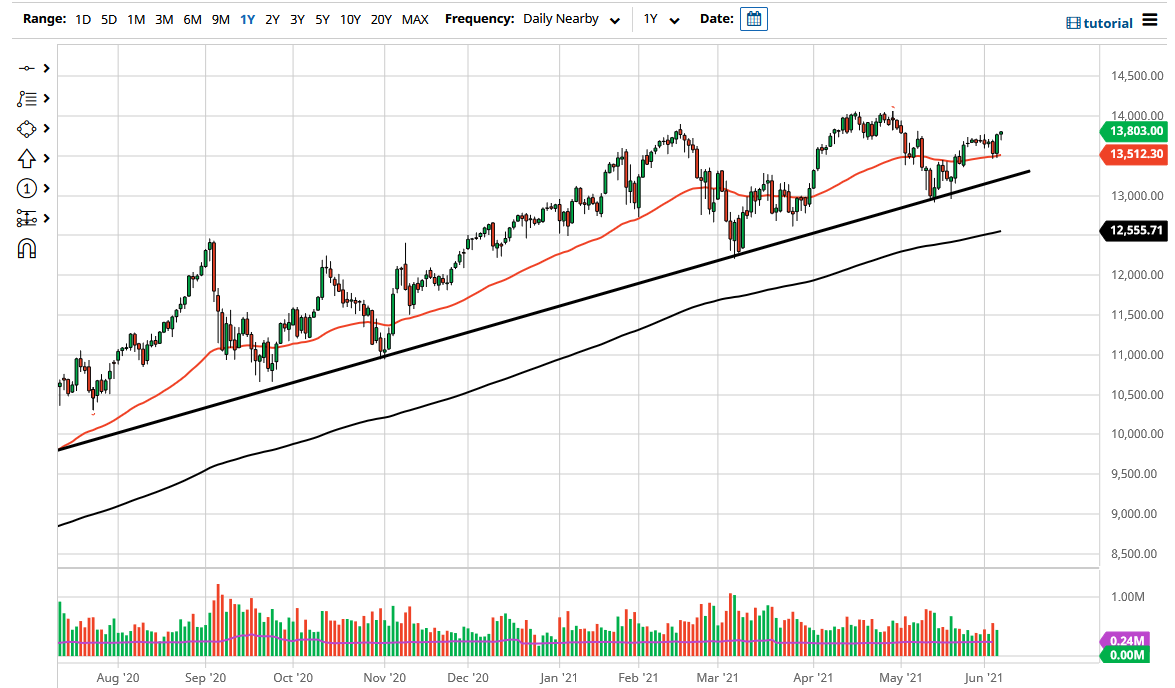

The NASDAQ 100 pulled back a bit during the trading session on Monday but then turned around to show signs of strength again. Ultimately, the market looks as if it is ready to go to the upside, perhaps reaching towards the 14,000 level above. The 14,000 level above is a significant resistance barrier based upon the recent pullbacks, and I think that if the market could break above there it is likely that we could see a bigger move.

The 50-day EMA sits underneath and offers plenty of support, sitting right at the 13,500 level. After that, the uptrend line comes into the picture offering support, as it has for quite some time. It looks as if the market is trying to form a bit of an ascending triangle, which is a bullish sign as well. If we can break out to the upside, I fully anticipate that we could go looking towards the 14,500 level, perhaps even the 15,000 level, which is a large, round, psychologically important figure.

If we were to turn around and break down below the uptrend line, then the market would go looking towards the 13,000 level, which was the most significant swing low as of late, and also probably attracts the 200-day EMA given enough time. The market has been in an uptrend for quite some time, but I also recognize that we might be in for bigger moves longer term, as the liquidity measures continue to prop up markets in general and, if the interest rates start to slide a bit in the United States, that could help the idea of growth stocks such as technology get into rally mode as well.

If we did break down below that uptrend line, then it is likely that I would be a buyer of puts, but I would not short this market, due to the fact that it is so bullish and the central bank in the United States will do everything it can to keep markets afloat. Ultimately, it is all about free and easy money, and simply following the narrative that is being floated around on Wall Street at that moment in time. The market is going from the lower left to the upper right, so that is essentially the most important thing to know.