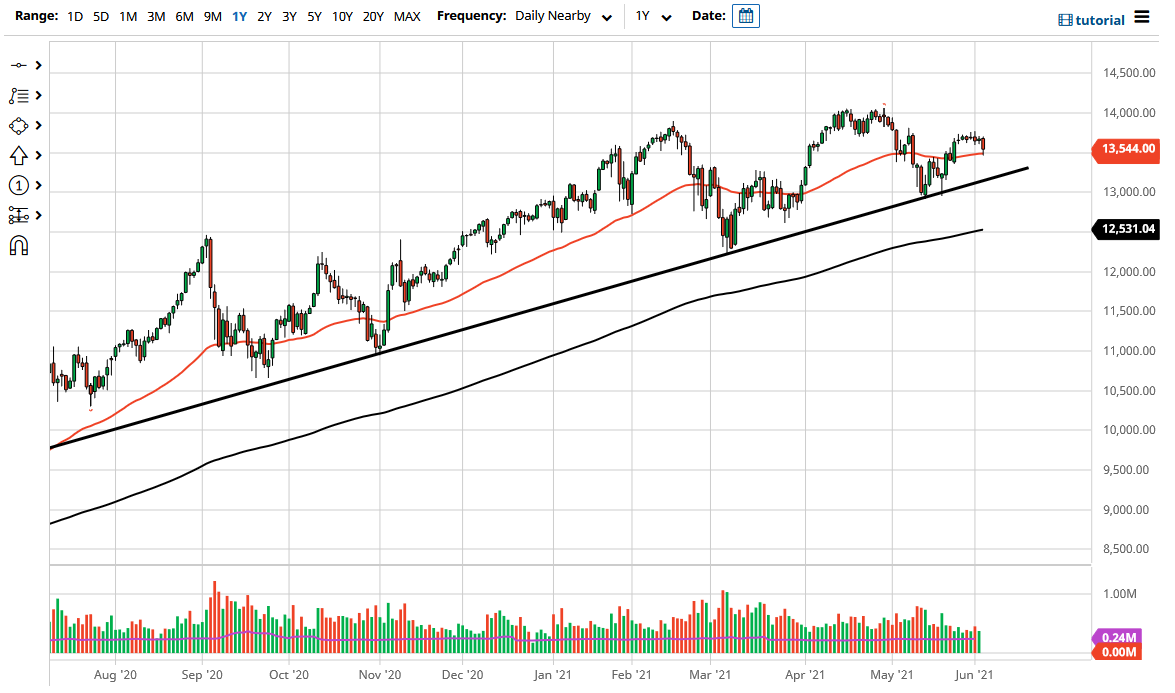

The NASDAQ 100 has pulled back a bit during the course of the trading session on Thursday but as you can see, we have stopped at the 50 day EMA. The 13,500 level also has offered support, and therefore it looks like the market is likely to find value hunters underneath. At this point time, the market should continue to go higher based upon the overall liquidity flows, but the reaction on Thursday to the Initial Jobless Claims being stronger than anticipated shows that the market is that afraid of tightening monetary policy. Nonetheless, I think by the time this is all said and done this will be yet another “blip on the radar” that we forget about.

To the upside, the 14,000 level would of course be an area where a lot of selling pressure and psychological interest will be, and therefore I think that it might be a bit difficult to get above there. If we can get a sustained move on a daily close above there then it is likely that we could go looking towards the 14,500 level, possibly even the 15,000 level. All things been equal, this is what I anticipate seeing, but is probably to take a while to make that happen.

On the other hand, if we were to break down below the 50 day EMA and make it stick a bit, there is also an uptrend line underneath that should come into play. The 13,000 level is just below there and supportive, but if we were to break role that I would be more likely to be a buyer of puts, because you can mitigate all of your risk to the premium that you pay. After all, if the stock markets freak out, the Federal Reserve will almost certainly jump into saving everybody, as they have proven themselves to be likely to do over the last 13 years. With this, I think that dips eventually get bought but I would not lever positions, and I would most certainly be cautious about jumping all in right away, so with that I like the idea of simply building a position size in order to take advantage of the trend, gradually getting bigger and bigger as the situation works out. A breakdown below the 200 day EMA, I suspect it would only be a matter of a few days before Jerome Powell rides to the rescue.