For what it is worth, I suspect that the markets are simply waiting on the Consumer Price Index, as we continue to have arguments about whether or not inflation is here. Because of this, I think we could get a bit of noisy trading, but any significant pullback should end up being a nice buying opportunity. After all, we have been in a massive uptrend for quite some time, and I just do not see that changing.

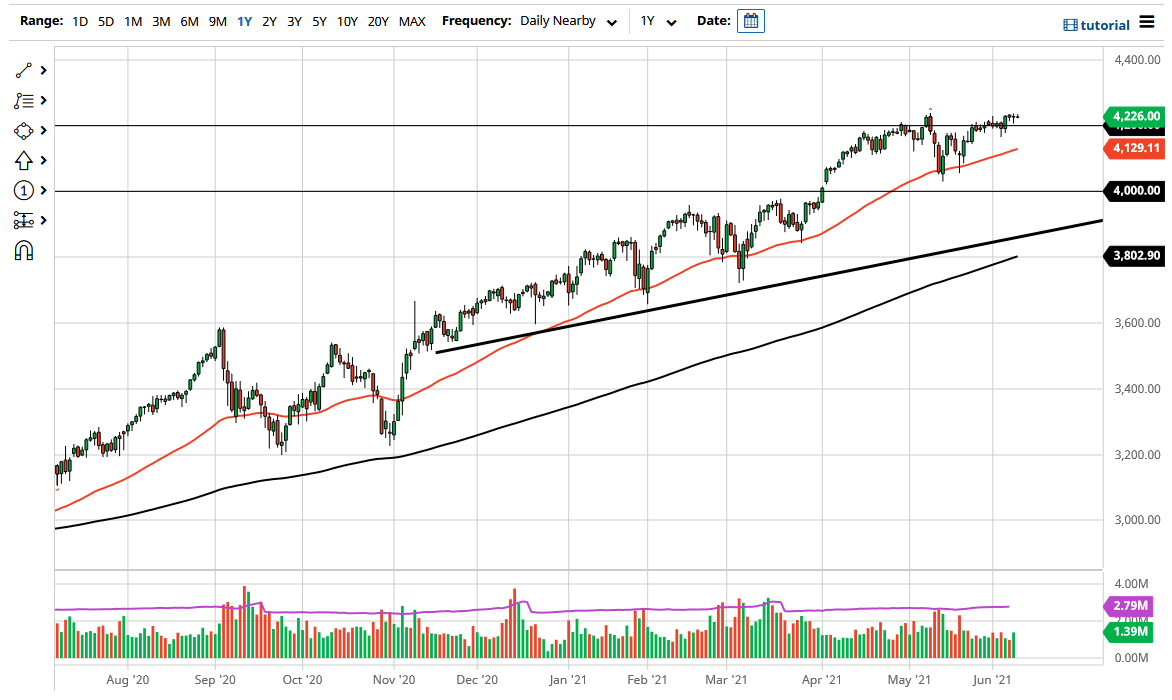

Underneath, the 50 day EMA has offered dynamic support, and that should offer a bit of support if we do get a bit of a breakdown. After that, we have the 4000 level which of course is a large, round, psychologically significant figure that is also backed up by a small gap, so there is a couple of different reasons to think while we are going to go higher. This does not necessarily mean that it will be easy to go higher, but there are obviously a lot of buyers underneath between here and 4000 that are willing to step in and support the market.

If we can break out to the upside, then it is very likely that the S&P 500 goes looking towards the 4300 level, followed by the 4400 level, which is my interim target. I think we go higher than that, if for no other reason than the fact that people are looking to do something with their money in order to protect wealth from relentless inflation. This is what makes the Thursday session so interesting, because the CPI numbers will give us a bit of a headline on where that is going.

Nonetheless, I look at this as a nice opportunity if we do sell off, then I will simply be looking for signs of support that I can take advantage of as the longer-term trend will not be broken during the trading session on Thursday. With this, I am a “buy on the dip” type of trader, just as I have been for several years now. I have no scenario whatsoever in which I am actually willing to short this market. However, if we were to break down below the 4000 level, I might be talked into buying puts, but I will have to take a look at that as it occurs.