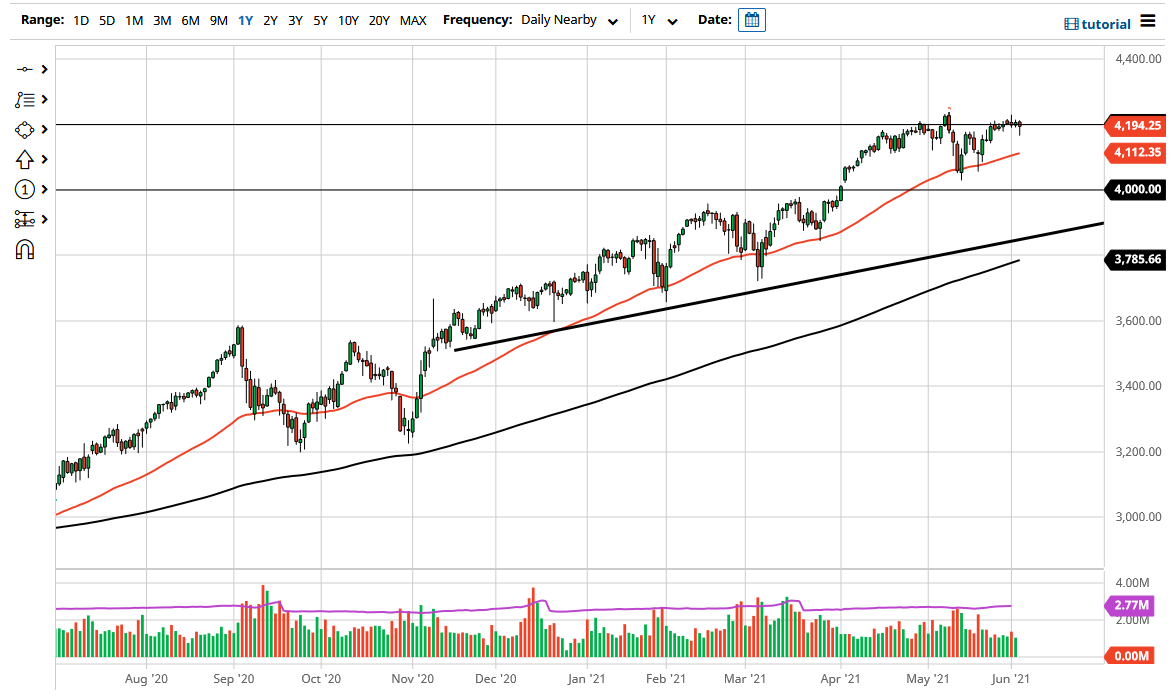

The S&P 500 has pulled back just a bit during the course of the trading session on Thursday again as traders freak out about the initial Jobless Claims, being under 400,000. While this would sound like a good thing for the economy, the reality is that Wall Street is more worried about cheap money coming out of the Federal Reserve than anything else. There were concerns about the Federal Reserve being forced to taper sooner rather than later, so algorithms went buck wild.

Ultimately, this is a market that I think will continue to see buyers on dips due to the fact that all of the factors that have been driving this market higher all along are still current. The recent pullback reached towards the 50 day EMA before we rally it off of a massive shooting star, so now it looks as if we are trying to do the same thing again, but we have the jobs number on Friday coming and that of course is a major influence. I think that if we do sell off rather drastically due to the jobs number coming out, then I think there should be plenty of buyers underneath based upon the recent action, and therefore as long as we can stay above the 50 day EMA, I think that value hunters will come back into the picture.

That being said, we could also break out to the upside, but we would need to clear the 4230 level on a daily close to have the “all clear” to start buying for a bigger move, which probably opens up the possibility of a move towards the 4400 level. The market has a proclivity to go back and forth through 200 point intervals, so that is another reason why I think the 4400 level could be targeted. Underneath, the 4000 level should be essentially the “floor the market”, as it is not only a large, round, psychologically significant figure, but it is also where the gap sits that has yet to be filled. Because of this, the market is likely to continue finding plenty of buyers on any significant pullback. All things being equal, this is a market that I do think continues to go higher and therefore I remain bullish, but I also look for value as it seems to return.