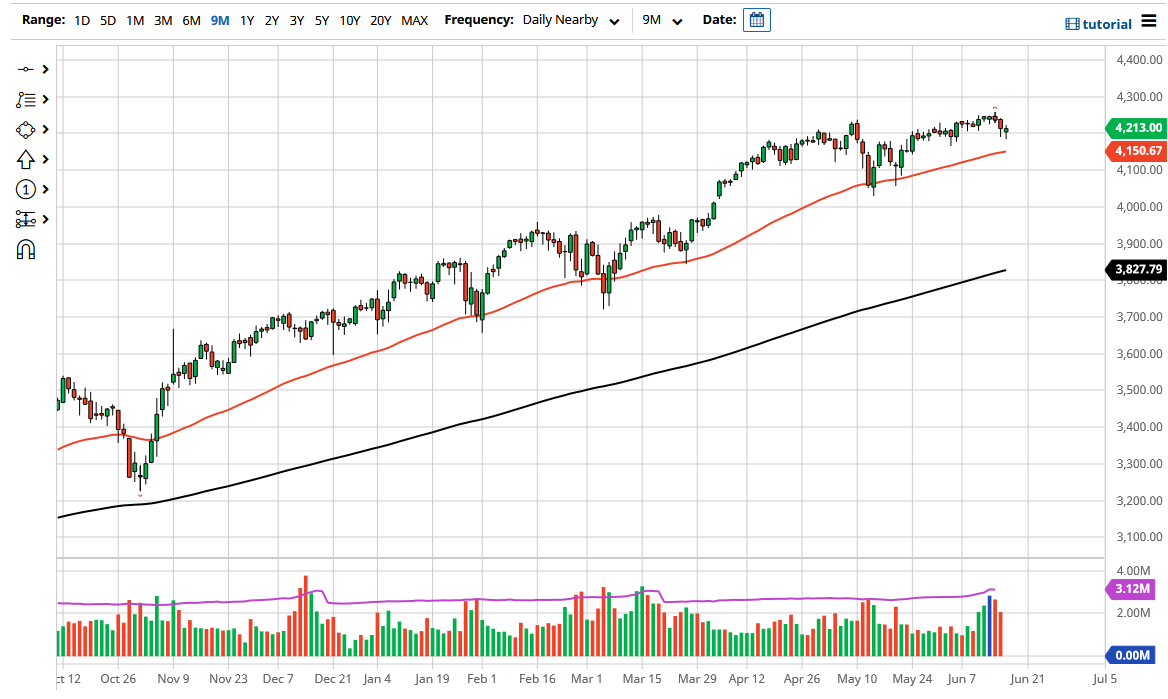

The S&P 500 initially pulled back a bit during the course of the trading session on Thursday to reach down below the 4200 level. Traders are still terrified of the idea of the Federal Reserve stepping in and tightening monetary policy, which is a bit ridiculous considering that we are talking about two years from now. That being said, the market is likely to continue to see a lot of volatility, but as we are looking at the overall big picture, there is still the “reopening trade” that a lot of people will be paying close attention to. That being said, I like the idea of buying dips at the 4200 level, as well as the 50 day EMA underneath which is only 50 points below there.

Underneath all of that, the 4000 level is of course a large, round, psychologically significant figure that is also backed up by the gap that sits at that area as well. The 4000 level being broken to the downside could open up the possibility of a move towards the 200 day EMA, or perhaps even worse. That being said though, I have no interest in trying to short the market flat out, rather I would be a buyer of puts because at least that way I could keep my risk profile relatively low.

At this point though, I fully anticipate that the market is probably going to turn around and try to rally towards the highs again. After all, we have seen a bit of a reaction to the Federal Reserve announcement, but there is a huge case to be made for the fact that it might have been overdone. The Federal Reserve is nowhere near tightening anytime soon, and they will of course do whatever they can to satiate Wall Street, as they approve a multiple times over the last 13 years. That being said, if the market to sell off quite drastically it will probably only end up being a nice buying opportunity before it is all said and done. After all, if the Federal Reserve is going to have to tighten monetary policy, that would be due to the fact that the economy was doing better than anticipated. Given enough time, this market will continue to find its bullish momentum regardless of the next couple of days.