The S&P 500 futures contract was open for trading on Monday for shortened hours due to the Memorial Day holiday. That being said, we did lose 11 points, which suggests that there could be a little bit of hesitation going forward, as the 4200 level continues to be important. The 4200 level is a large, round, psychologically significant figure that is worth paying attention to, so I think it makes sense that we have stalled here. It is also probably a bit much to expect that the market would simply break out in such thin conditions.

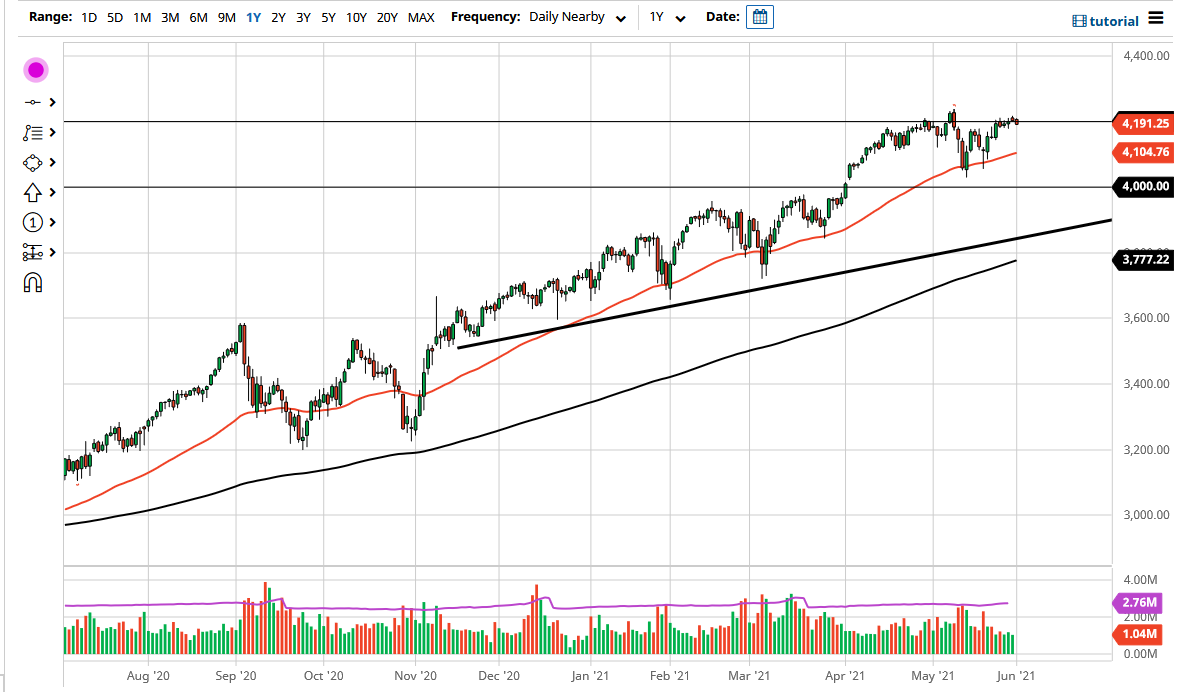

When you look at the chart, you can see that there has been a bit of a pullback near the 4235 level, so it is very likely that we could see a certain amount of hesitation here. This leads me to believe that short-term pullbacks will be thought of as buying opportunities, especially if we get some type of significant move towards the 4100 level, which is where the 50-day EMA currently sits. After that, we have a massive amount of support at the 4000 level due to the large, round, psychologically significant aspect, but it also has a gap there that should continue to offer support as well.

I do not have any interest whatsoever in trying to short this market, and at this point I am looking at pullbacks as potential buying opportunities. Looking at this chart, some people will be looking at it through the prism of a potential “double top”, but I do not think that is the issue right now, and it is almost impossible to get short of a market that is being pushed up by all of the liquidity thrown out there by the Federal Reserve. After all, money is looking for a place to beat inflation, and recently it has been all about the stock market. With that being the case, the market is going to continue to be a “buy on the dips” scenario. In fact, I do not even have a situation where I would be short of this market, but I could consider buying puts underneath the 4000 handle. That would be a short-term trade more than anything else, but could be a profitable one if there is a sudden flush lower.