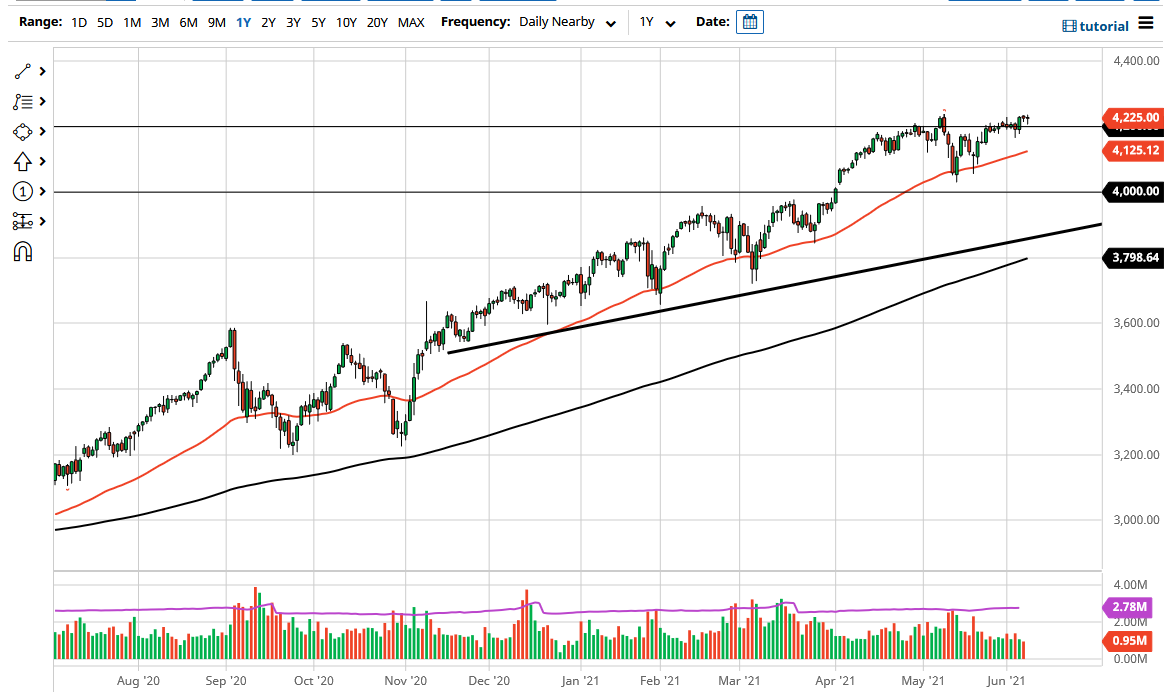

The S&P 500 pulled back during the trading session on Tuesday to reach towards the 4200 level. The 4200 level is a large, round, psychologically significant figure, and an area where we have seen quite a bit of resistance previously, and one that will attract a lot of attention. The fact that we have bounced hard from there during the trading session on Tuesday only reaffirms the fact that we are very much in an uptrend. As we are essentially pressing a “potential double top”, think a lot of traders out there will be very cautious, but we are very much in an uptrend, and it looks like we are going to go looking towards the 4400 level.

To the downside, the 50-day EMA comes into the picture as dynamic support at the 4125 handle, and should attract a lot of attention as it is a popular technical indicator. If we break down below there, then it is likely that we will go looking towards the 4000 level, which is a large, round, psychologically significant figure as well, and an area where we would see a little bit of a gap that could offer support. That being said, I do think that the market will eventually go higher, as it could open up the possibility of value hunting.

I do think that as long as we continue to see more of an upward push, then it is likely to be in response to the liquidity measures that the Federal Reserve is forcing down the throats of almost everyone. With that being the case, it is difficult to imagine a scenario where I would be short of this market, and at this point it is not until we break down below the 4000 level that we even have to have the possible conversation. Even then, I think in puts rather than shorting the market, because every time it does sell off, it is only a matter of time before the Federal Reserve comes in to disrupt markets and push them to the upside. I know it is not necessarily the way things are supposed to work, but it is how things have worked for the last 13 years. It is what it is, and at the end of the day it is the market that we are stuck with.