The S&P 500 rallied a bit during the trading session on Tuesday as we continue to see the market rally to the upside. We have not reached the all-time highs again, but we almost certainly will over the next several days. The S&P 500 has been worried about the Federal Reserve tapering, which is an absolute joke.

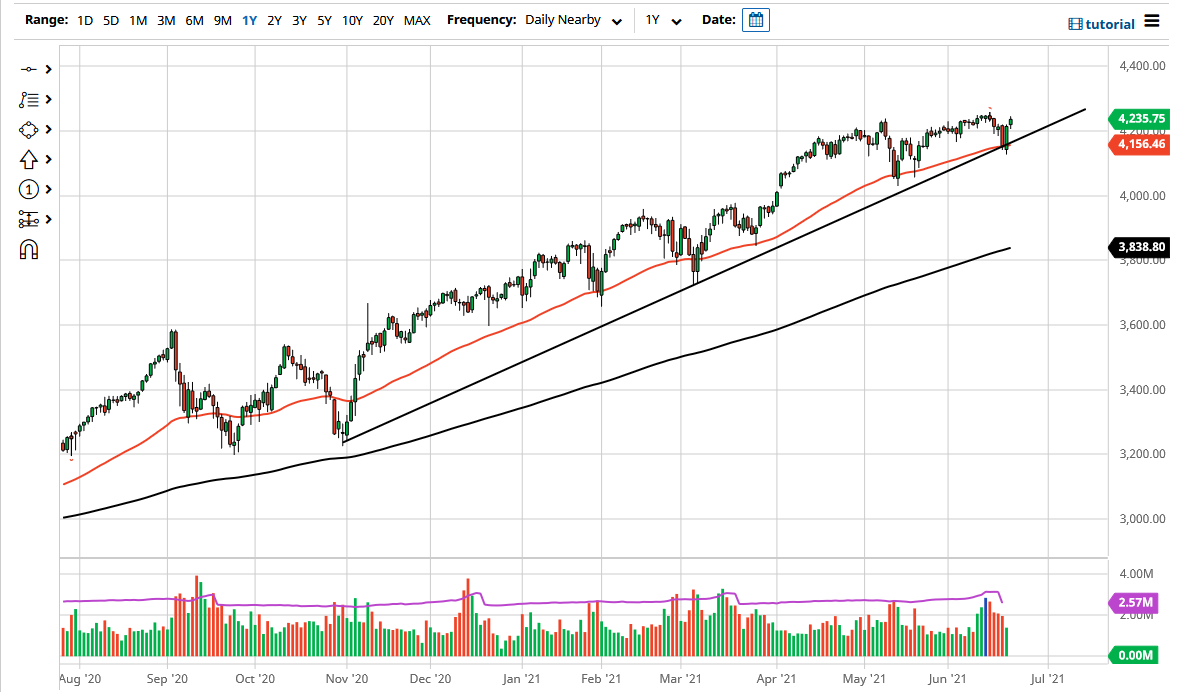

The Federal Reserve is “thinking about thinking about tapering”, which suggests to me that by the time they would get around to it, it would probably be time to loosen up yet again. With that being the case, the market is very likely to continue seeing buyers on dips as the 4200 level in and of itself would be reason enough to pay attention. Furthermore, we also have the uptrend line that is coming into the picture, which is also backed up by the 50-day EMA. As you know by now, I have no interest whatsoever in shorting US indices, because they can rip your face off if you are not careful.

If we did break down below the trendline and the 50-day EMA, it is very likely that the market would go looking towards the 4000 level for potential support, as it is not only a large, round, psychologically significant number, but there is also a gap that has not quite been filled completely. Nonetheless, this is a market that I think will continue to go higher before it goes lower. Even if we did break down below that 4000 handle, I would be a buyer of puts, but I would have no interest whatsoever in trying to short this market because the Federal Reserve will get in the way of the market falling. Do you not believe me? Just look at the way they have walked back the hawkish sentiment in just the last few days over the market dropping a couple of percent. Remember, it is not what they say, it is what they do that matters. One thing that we have learned over the last 13 years is that the Federal Reserve cares very much what the stock market does, and will continue to try to manipulate it higher. Someday it will not work, but my suspicion is that we are near anywhere near that day.