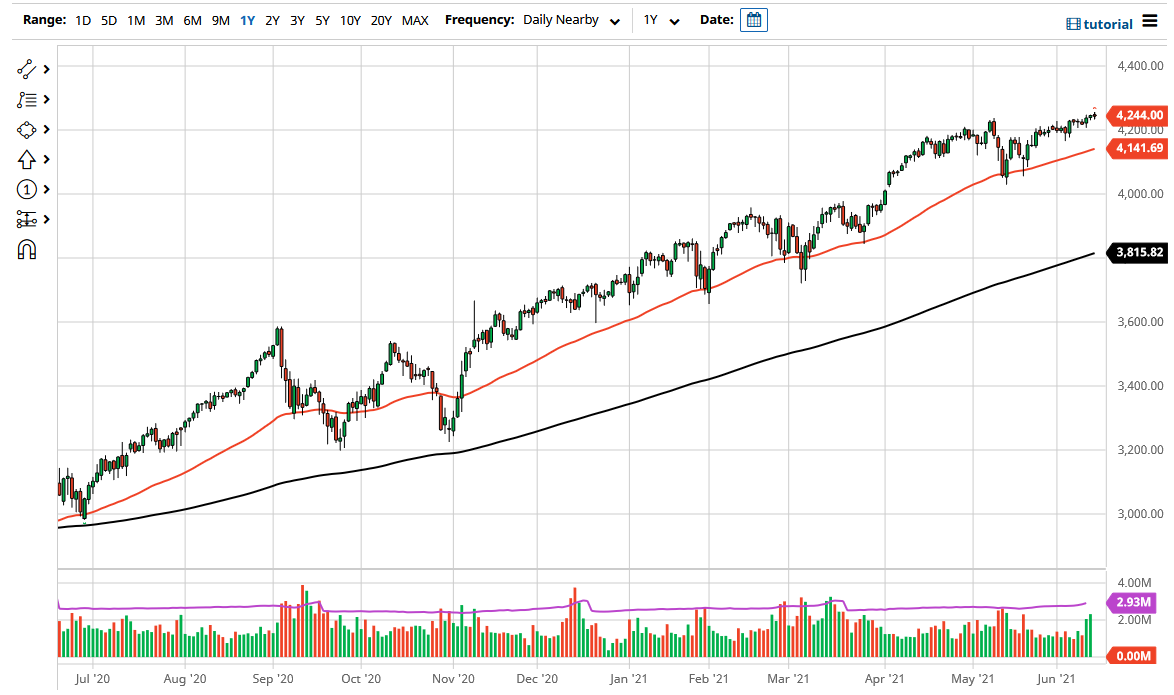

The S&P 500 was slightly positive during the trading session on Monday to kick off the week, but it is a little lackluster as far as performance is concerned. After all, we have broken to the upside and cleared the previous high, but still could not pick up momentum. This does not necessarily mean bad things; it just suggests that we probably have some work to do and it is probably more of a grind than anything else.

The S&P 500 is being supported by the central bank, with the Federal Reserve adding liquidity into the mix in order to keep asset prices going higher. It is a huge benefactor of liquidity, as it is the first place that people throw money at. The 4200 level underneath is massive support, but not the “be-all and end-all” of support. The 50-day EMA sits underneath at the 4140 level, and I think that offers a certain amount of support, as we have seen the 50-day EMA be so reliable, almost as if it is a trendline. After that, then we have the 4000 level, which is psychologically important and also has a gap sitting there that could come into the picture, showing signs of massive support and essentially what I consider to be the “floor in the market.”

If we were to break down below the “floor in the market”, then I would be looking to buy puts, not necessarily shorting the market, as that is a fool’s errand to do so when the central banks will step in and do whatever they can to support markets. In fact, I suspect that if we break down below the 4000 level, it is only a matter of time before the Federal Reserve either states something or does something in order to support liquidity. It is because of this that I think you can only buy puts, not flat out short the market.

To the upside, if we break above the highs of the day, then I think we will continue to grind towards the 4400 level, which is my longer-term target. After all, the S&P 500 tends to move in 200-point increments, and I see no reason to think that is going to change anytime soon, as the behavior of the market has been so stable for several months now.