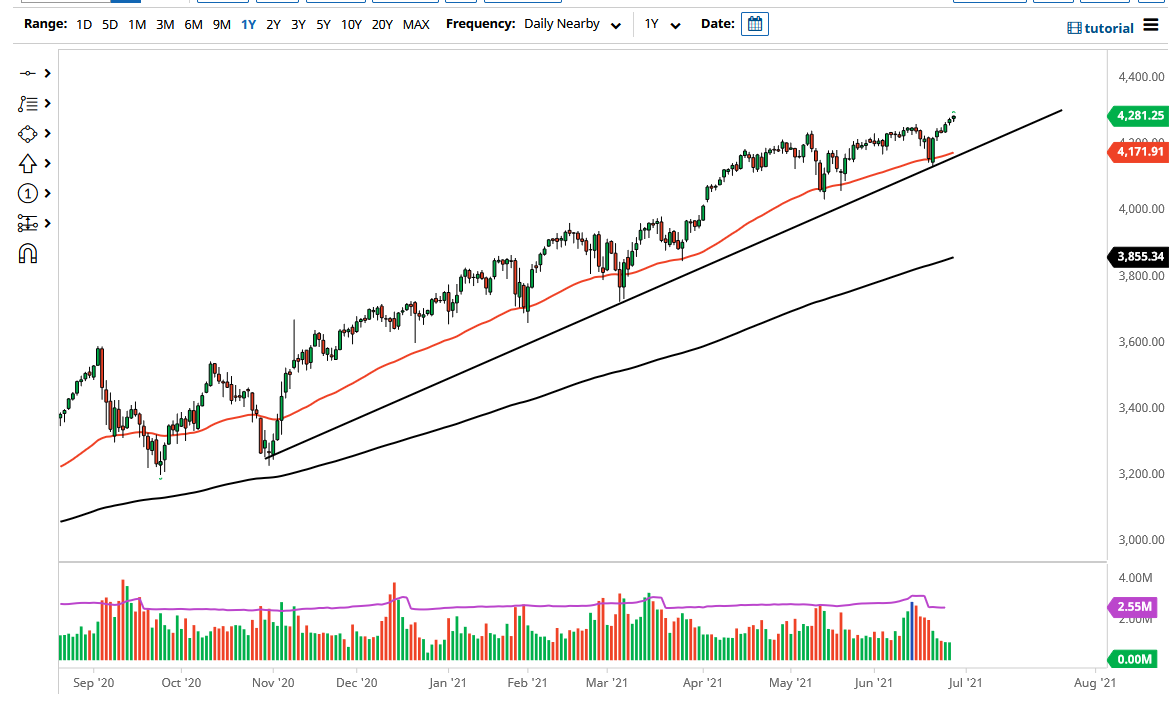

The S&P 500 gapped a little bit higher to kick off the trading session on Friday and then continued to go just a bit higher. This is a market that continues to see plenty of reasons to go higher and reach towards the 4400 level. After all, the market does move in 200-point increments, and it makes sense that we would go looking towards that level. At this point, a pullback should offer plenty of support near the 4200 level, especially as the 50-day EMA is reaching towards it. After all, the 50-day EMA is closely followed by technical traders, which make up a huge part of the market now.

Underneath the 50-day EMA, the market also features a significant uptrend line that has been followed for quite some time, so I think it is only a matter of time before we see plenty of value hunters coming into the market. The Federal Reserve continues to throw plenty of liquidity into the marketplace and it seems very unlikely that we will suddenly see some type of reversal. Because of this, I think that a lot of traders will continue to look at the stock market as the only option. This is especially so as bond yields are essentially falling at this point, and it does not seem like people are worried about trying to find yield in that scenario.

Ultimately, when you look at the massive selloff from last Friday and then the candlestick from Monday, it is a 48-hour hammer, and it is only a matter of time before the traders jump on the train. Even if we did break down below the uptrend line and the 50-day EMA, I think that the 4000 level will be massive support, as there is a significant gap there and it is a large, round, psychologically significant figure that a lot of traders pay attention to. It is not until we break down below there that I might be a buyer of puts, but at this point it is impossible to actually short this market, as the Federal Reserve has clearly continued to support stock markets in general