The S&P 500 rallied again during the trading session on Monday as we are starting to see traders press the issue as to whether or not Jerome Powell actually has the courage to tighten. At the end of the day, it is very unlikely that it will happen, as the chairman of the Federal Reserve is going to testify in front of the House of Representatives during the day on Tuesday. That being said, the market has been bullish for what seems like a lifetime, and every time we fall out of bed the Federal Reserve is there to say the day.

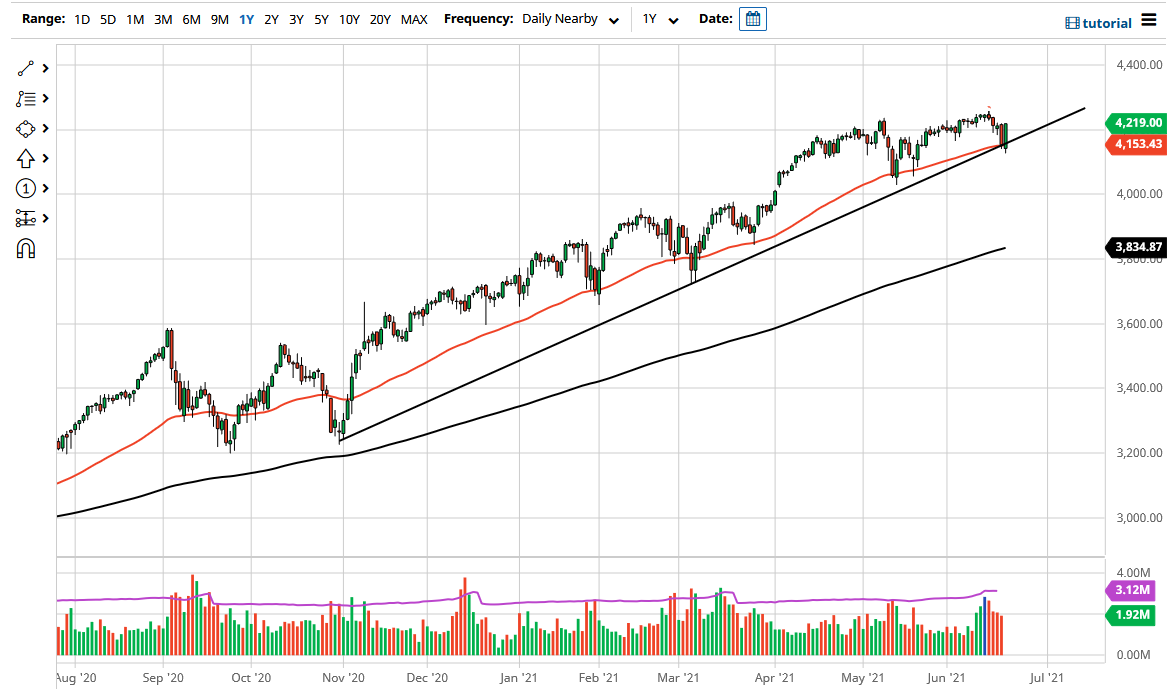

While St. Louis Fed Gov. Bullard suggested on Friday that the Federal Reserve is going to have to raise rates by the end of next year, the reality is that the market does not believe him. The market is also bouncing from the 50-day EMA, so it does suggest that a confluence of events are coming together for the stock market to continue the rally. Ultimately, the market is likely to go towards the high again, which would open up the possibility of a move towards the 4400 level.

If we break down below the lows of the trading session on Monday, then it is likely that we could go looking towards the 4000 handle, which is a large, round, psychologically significant figure and an area where we have seen a major gap form. Those are a couple of reasons to think that perhaps buyers would be in that area, looking to take advantage of value. If we were to break down below there, then it is likely that we are going to go looking towards the 200-day EMA. At this point, I would be a buyer of puts, but I would not be selling this market due to the fact that the market is highly manipulated by central bankers and liquidity issues. The market is a bit of a “one-way trade” over the longer term. The size of the candlestick and the fact that we are closing at the top of the range suggests that we are more likely than not to go much higher. The only way I see this market breaking down is if Powell says something stupid and disruptive during the session.