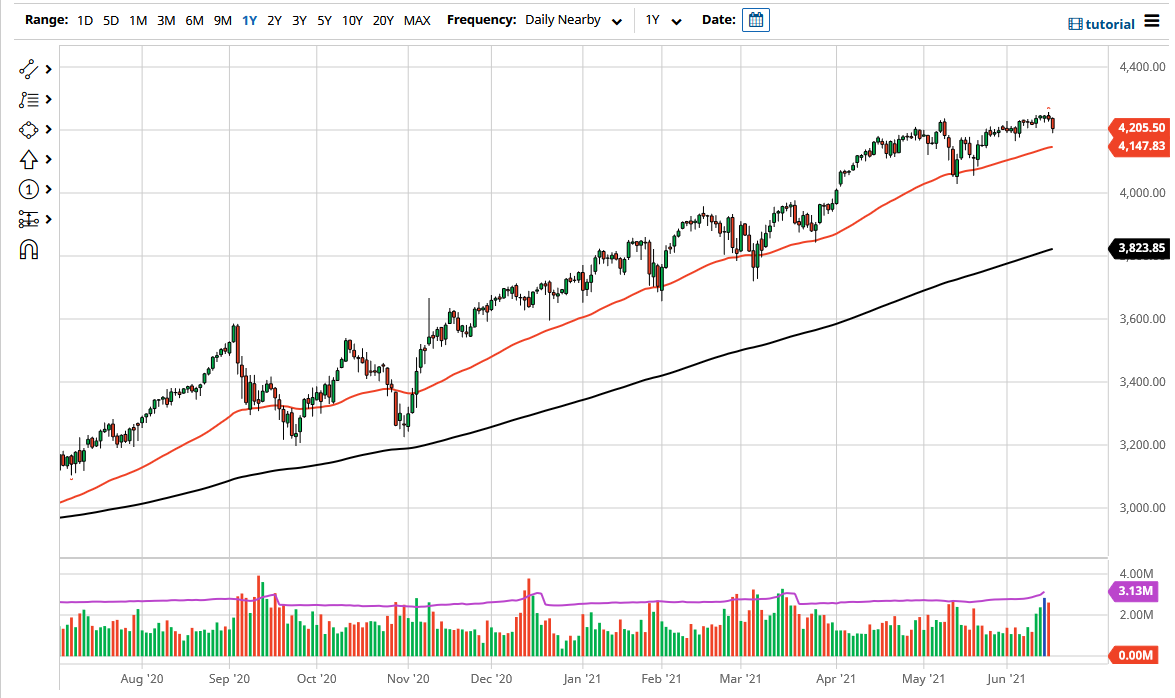

The S&P 500 dropped a bit during the trading session on Wednesday, as the Federal Reserve dot plot moved a little further towards present time, sending the S&P 500 down to the 4200 level. It was a very negative candlestick, but at the end of the day we held a major support level, so I think that it is only a matter of time before the buyers come back into the marketplace and try to pick up a little bit of value.

Looking at this chart, the 50-day EMA is reaching towards the 4200 level, so I think it will also offer a certain amount of support as well. With this being the case, the market is likely to find buyers sooner rather than later, as the market continues to see a lot of noisy behavior. Nonetheless, we are very much in an uptrend and that is the only thing that is reliable from a longer-term standpoint. Given enough time, we will go looking towards the 4400 level. Keep in mind, the Federal Reserve will pay close attention to the market, and step in to save it if there is any type of major meltdown.

A lot of this came down to the “dot plot”, which is an absolute headache of an indicator that explains where interest rates may be over the next several years. A couple of Federal Reserve members suggested that the next interest rate hike might be in 2023, which is still quite some time away, so that is part of the reason why I believe the market will probably work away the bearish pressure in the short term, so I think the next couple of days will be very noisy to say the least.

Nonetheless, I still think there are plenty of traders out there willing to pick up the market every time it falls, and I see the 50-day EMA as a major barrier. But even more importantly, I see the 4000 level underneath to be support as there is a major gap there. It is not until we break down below there that I would become a bit concerned about the market, and even then, I would only be a buyer of puts. Ultimately, this is a market that I think cannot be shorted.