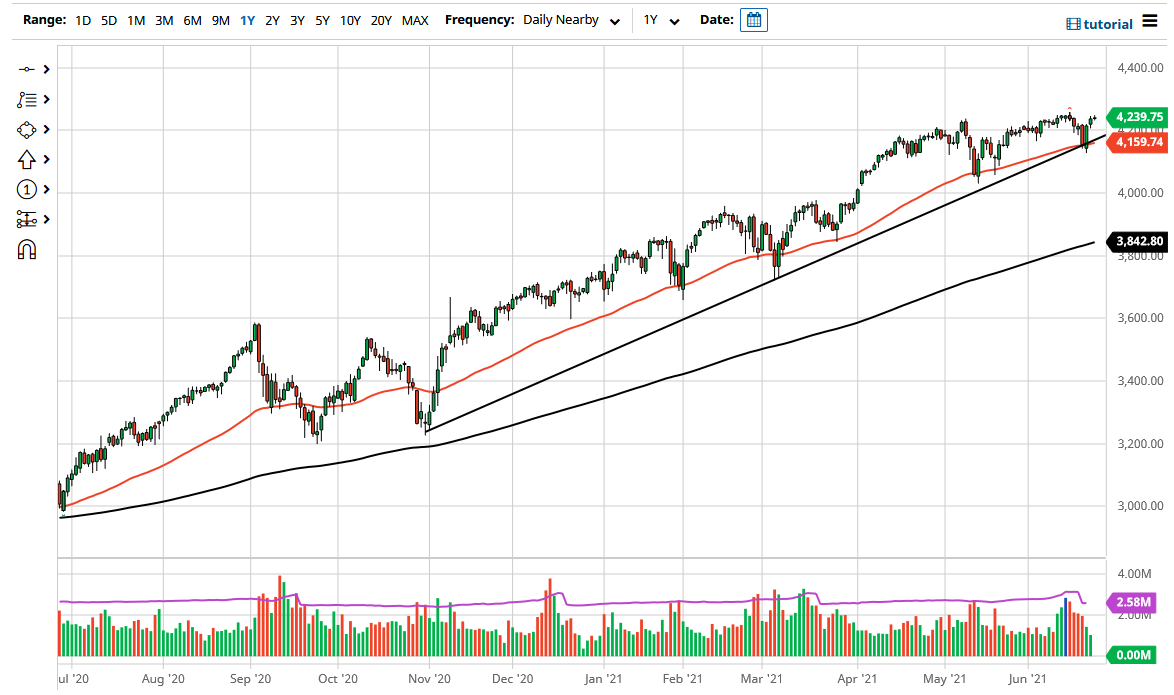

The S&P 500 went back and forth during the trading session on Wednesday as it continues to reach towards the all-time highs. We have yet to break out, though, so it makes sense that we may have to pull back a little bit in order to build up enough momentum to break out to the upside and go higher. Regardless, I have no interest in shorting this market, as the Federal Reserve will step in and lift the markets as they have multiple times. Furthermore, when you look at the chart, you can make an argument for a bit of an ascending triangle, thereby showing signs of possible momentum on a breakout.

Underneath, there is the 50-day EMA, which is walking right along the uptrend line, but before you even get to that point, the 4200 level should offer support as well. However, if we were to break down below that uptrend line, then I think that the S&P 500 very well could go down to the 4000 handle. The 4000 handle is a large, round, psychologically significant figure that will attract a certain amount of attention, as buyers may be interested in picking up value in that general vicinity. Furthermore, there is also a gap sitting in that same area, so I think that is probably going to be about as bearish as this market gets.

However, if we break down below the 4000 handle, it is possible that we may continue to go lower, but I do not have any desire to short this market because every time it falls, the Federal Reserve jumps in and turns things around one way or another. In fact, they have already started to walk back some of the hawkish attitude over the last couple of days on a mere 2% correction. At this point, the market is likely to continue to go higher given enough time, if for no other reason than the habitual attitude of the markets due to the liquidity in the central bank itself. I have no interest in trying to fight the rising tide, so this remains a bit of a “one-way trade.” Ultimately, this market tends to move in 200-point increments, so 4400 is what I am looking at more than anything else.