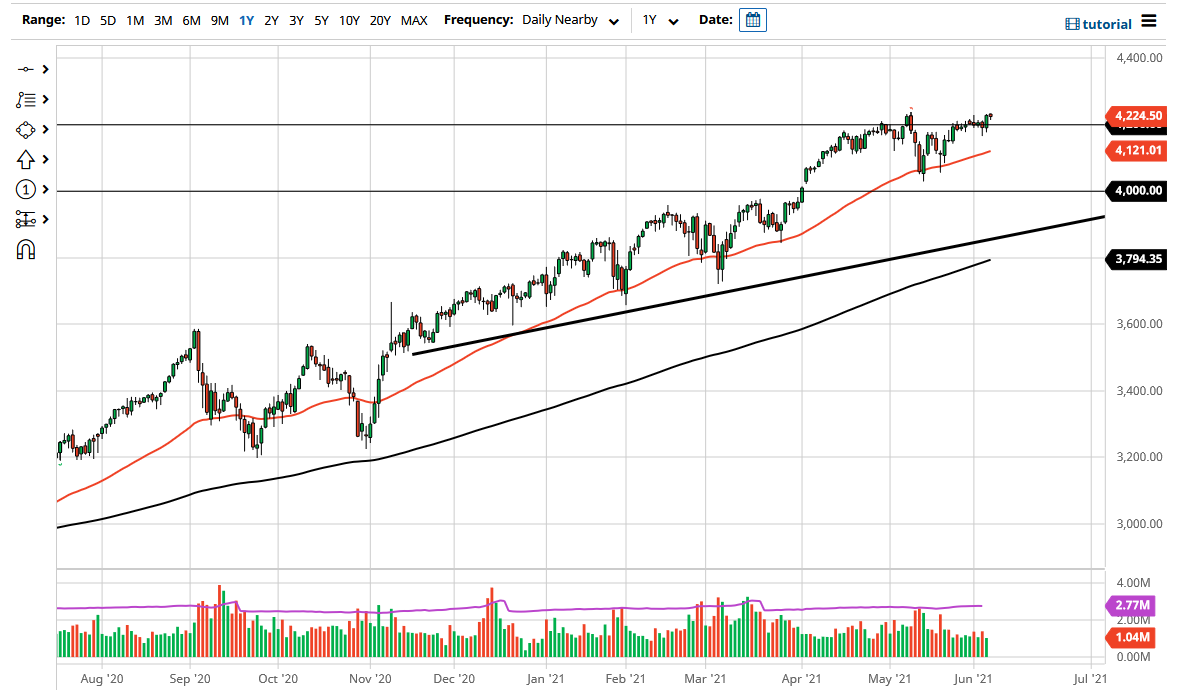

The S&P 500 fluctuated during the session on Monday in very choppy and sideways trading, which is what we have seen for the last several weeks. One thing to take away from this chart is that we did not give up most of those gains from the session on Friday, so this does suggest that there is a little bit of underlying power to this market. The 4200 level underneath should continue to offer support as well, just simply from the psychological and structural support that has been found there multiple times in the past.

Looking at the chart, you can also see that near the 4120 handle there is quite a bit of interest, and that seems to be highlighted by the 50-day EMA coming into the picture as well. Because of this, I have no interest in shorting this market and even recognize that another drop down to the 4000 level would be even more supportive than the other ones, as there is a rather significant gap that sits just above that large, round, psychologically significant figure. I do believe that it is only a matter of time before the buyers come back into this market to pick it up, because the liquidity issues alone continue to push the market higher.

While I do recognize that we are in the stock market bubble, the reality is that we have been in it for years, and these things can last much longer than most people believe. Because of this, you need to be very cautious about trying to “time the top”, but as far as buying dips are concerned, it is very likely that you will find plenty of opportunities to do so. Wall Street is great at creating the next narrative, so they will certainly see some way to push the market higher given enough time. Furthermore, you can also make an argument for a bit of an ascending triangle, which measures almost 200 points, suggesting that we could go looking towards the 4400 level. The S&P 500 does tend to move in 200-point increments anyways, so there are a lot of different reasons to think that perhaps we should continue to go higher over the longer term. I have no interest whatsoever in shorting anytime soon.