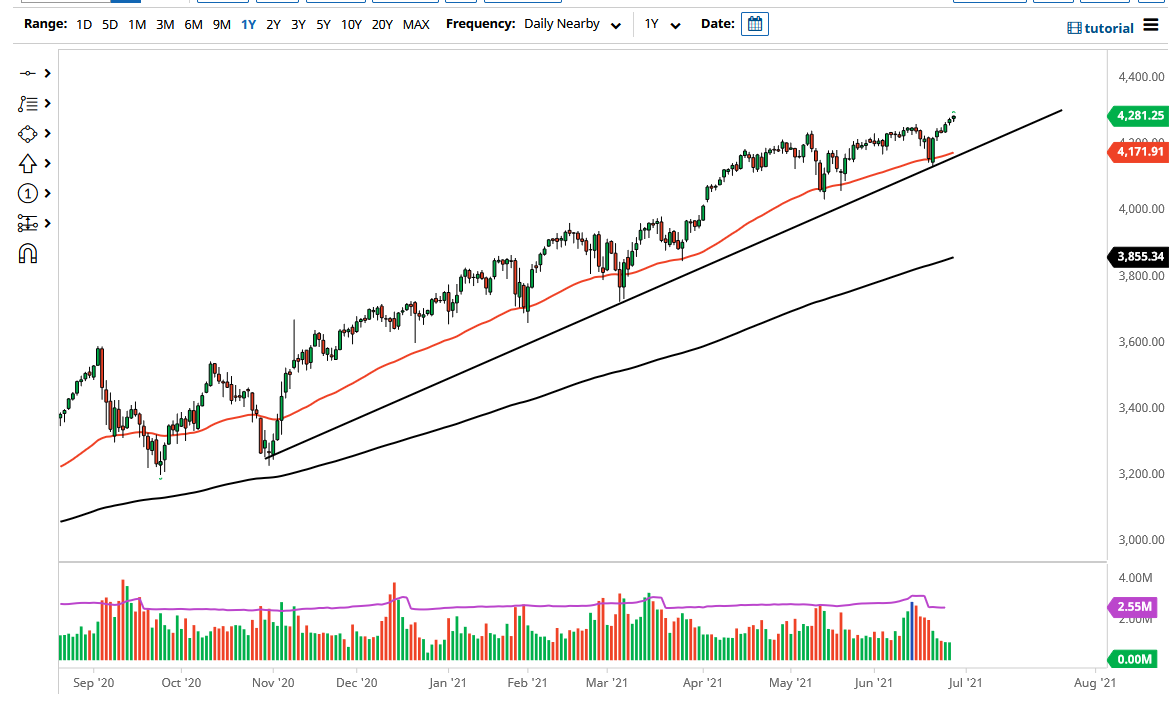

The S&P 500 rallied a bit during the trading session on Monday to reach all-time highs yet again. The market is likely to see pullbacks as buying opportunities. After all, this is a market that has been in an uptrend for quite some time, and it is likely that the 50-day EMA underneath will continue to offer a significant amount of support as it walks right along the uptrend line that has been so important for so long.

If the market continues to see the same behavior, then I would anticipate that we would see the 200-point increments attract the market. In other words, the 4200 level underneath should be supportive right along with those things that I mentioned before, with the 4400 level being a bit of a target. This is a market that is an uptrend and that has not changed, nor will it anytime soon.

Breaking down below the uptrend line and the 50-day EMA, the market should go looking towards the 4000 level underneath. After all, the 4000 level has been a major area worth paying attention to. There is a small gap at the 4000 level that I think you need to pay close attention to as well, especially as the large, round, psychologically significant figure comes into play. This is a market that is very bullish, and as a result, I think that every time we dip there should be a potential buying opportunity to take advantage of.

At this juncture, the market should continue to see plenty of people jumping in because the Federal Reserve is going to continue to throw liquidity into the marketplace any time it needs to. The market continues to be one of those things that is on the minds of central bankers, and as long as that is going to be the case, the market is likely to see plenty of reasons to continue higher. That being said, we are not that far from quarterly reports, so that could be a nice catalyst for the next push higher. The only thing I see on the horizon is the possibility of a strengthening US dollar causing a little bit of noise, but as long as it does not happen too quickly, we should continue.