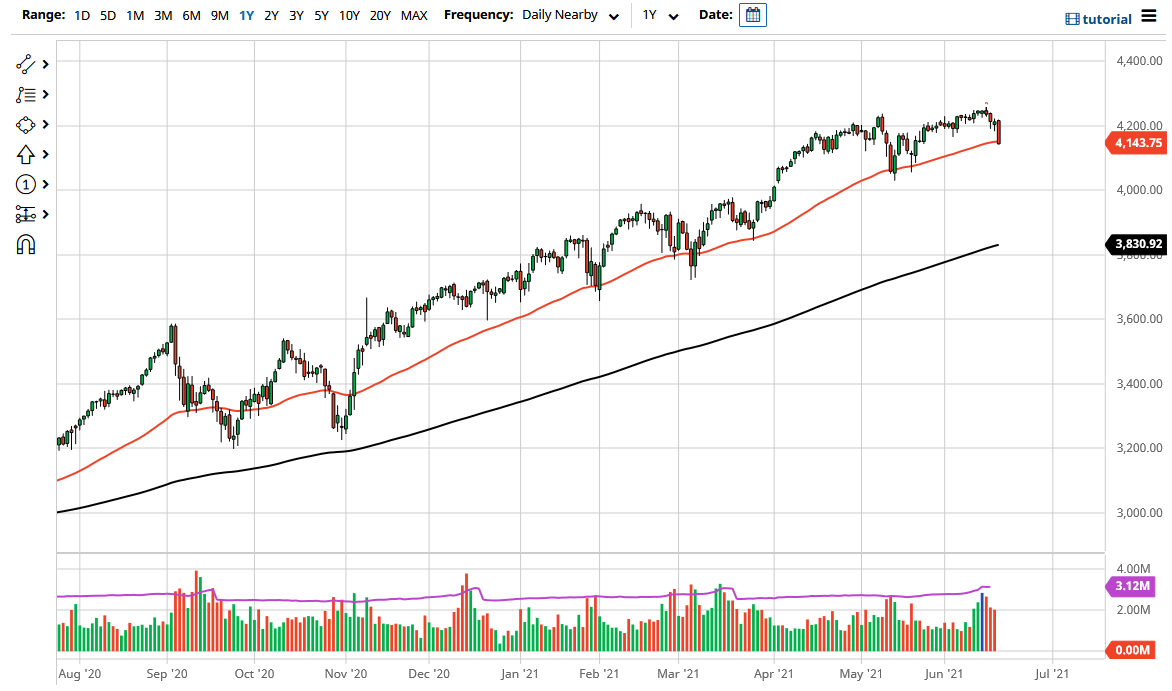

The S&P 500 was hammered during the trading session on Friday after St. Louis Fed Gov. James Bullard suggested that perhaps the Federal Reserve would have to start raising rates late next year, much quicker than the “dot plot” suggested on Wednesday.

That being said, the market is still very much in an uptrend, and I think it is difficult to sell the S&P 500 anyway. If the Federal Reserve starts to see some type of massive selloff, they will almost certainly jump in and say or do something to placate the market. Underneath, I think the 4100 level makes a lot of sense as potential support, but even more importantly would be the 4000 level, as it is not only a large, round, psychologically significant figure but it is also the scene of a gap that probably comes into play as well. It is at that point that I would anticipate plenty of buyers jumping back into the marketplace. The gap has not been filled, so it does make sense that it would happen.

Even if we break down below the 4000 handle, I would not be a seller. I would be a buyer of puts in the options market on something like SPY, and as a result I think what we are looking at is a scenario that we would probably make a quick “smash and grab” type of play, because it is only a matter of time before the Federal Reserve turns around and makes a market rep straight up in the air. It is their job, and it is the only mandate they seem to have these days.

With everything that has just happened, there should be a significant amount of value offered given enough time, but I think that we may have a little bit more of negative behavior in the short term due to the fact that we closed at the very bottom of the range. That being said, I believe that if you are patient enough you should get a nice opportunity on some type of “turnaround session” where we see something like a hammer form on the daily candlestick. As far as this market is concerned, I highly doubt that I would be trading it on Monday.