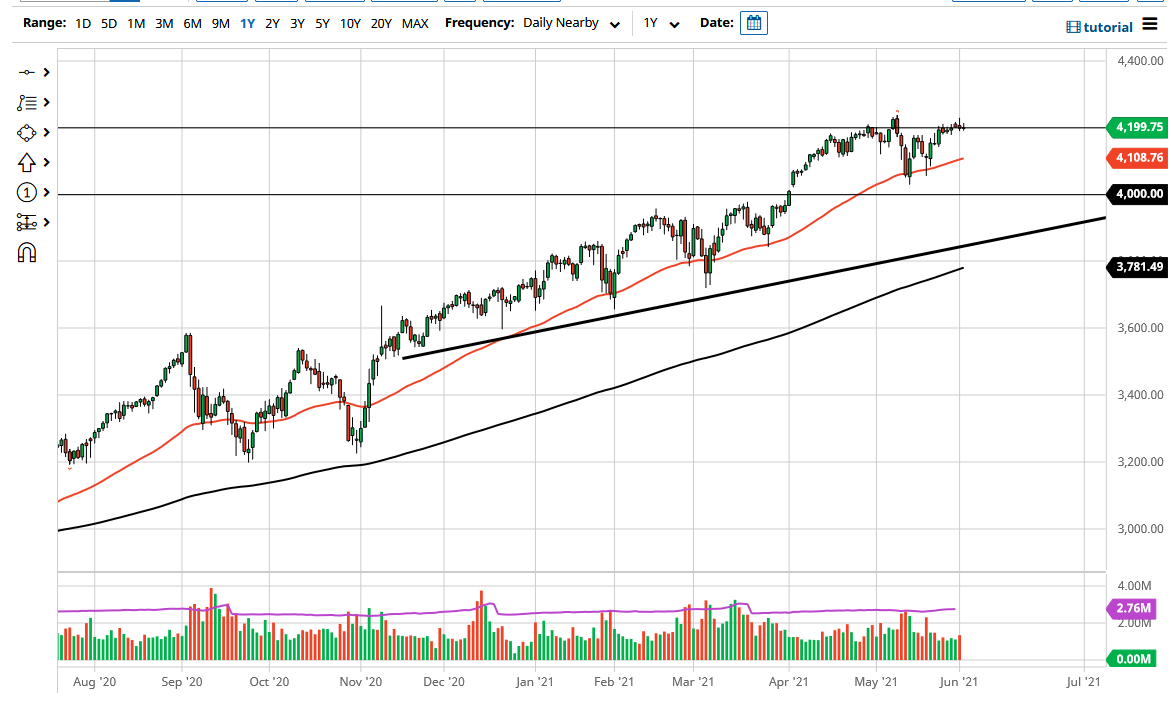

The S&P 500 initially sold off during the trading session on Wednesday to reach down below the 4200 level, but we have since turned around to hang right around that level. This seems to be a bit of a magnet for price, and as we await the jobs number on Friday, it is hard to imagine that this market is going to take off in one direction or the other. It is not that we cannot have some type of reason to shoot higher or lower, it is just that unless we get some type of “event”, it is very unlikely that we will move.

Looking at this chart, it is obvious that the market is going to continue to go to the upside, but one thing that you can take a look at more than anything else is the fact that we are forming a bit of an ascending triangle. If we do continue this overall sideways grind, it is likely that we could go looking towards the all-time highs again, which are closer to the 4250 handle. Breaking above there is a “new all-time high”, and would almost certainly kick off the move higher, perhaps reaching towards the 4400 level.

The market tends to move in 200-point increments, and as you can see, the 4000 level underneath should be rather important based upon not only that, but the fact that it is a large, round, psychologically significant figure and an area where we have seen a nice gap that would come back into play as well. If we were to break down below there, then we have a nice uptrend line that would come into the picture and offer support.

I have no interest in shorting this market, because it only goes up over the longer term. Yes, I recognize that occasionally we have a crash, and that is why you should keep your position size reasonable. Furthermore, you should also put in stop losses. However, with the Federal Reserve looking to boost the market every time it struggles, it is a loser’s game to try to start shorting this market. I do think that we will get to the 4500 level, but I also think it is going to take quite a while to get there. Thursday will probably be very quiet to say the least.