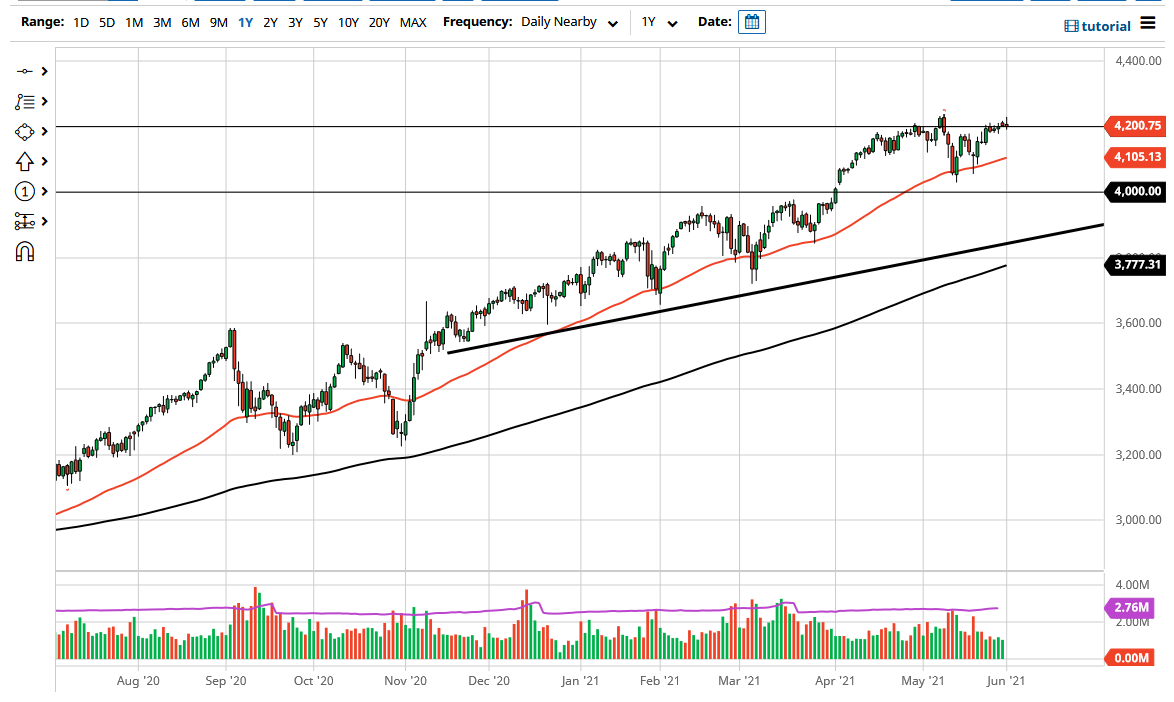

The S&P 500 tried to rally during the trading session on Tuesday but has shown itself wanting yet again. The shooting star that we formed for the session shows just how difficult it is to hang above the 4200 level for any length of time, so I think what we are seeing here is a market that has nowhere to be, perhaps not until we get beyond the non-farm payroll announcement. In other words, this could be a miserable week if you are looking for a bigger move. Nonetheless, the market is likely to see the longer-term uptrend continue, so even if we do pull back, I will not be a seller.

When you look at the 50-day EMA, it is currently at the 4100 level. At this point, I would anticipate that there should be a little bit of support based upon the large, round, psychologically significant figure and the 50-day EMA in and of itself. After that, we have the 4000 level, which also has a bit of a gap built into it that has yet to be filled, so it is likely that we would see buyers there as well.

To the upside, if we can make a fresh, new high, it would also be a significant all-time high, and it could have buyers coming in to push this market towards the 4400 level. The market does tend to move within 200-point increments, and I do not see that changing anytime soon. This is a market that is in an uptrend for a reason, and that is the fact that liquidity has been thrown into the marketplace at an alarming rate, meaning that holding cash is a great way to lose wealth. If that is going to continue to be the case, then it is likely that we will also see assets in general continue to rise, because there is no other thing that you can do at this point.

As long as it loses wealth for you to start saving, it makes sense that assets will continue to be purchased, especially as the reopening trade continues to be in favor. With the world opening up, company profit should continue to be strong, but stock markets have divorced from reality a long time ago, and corporate profits do not matter.