This week we will begin with our monthly and weekly forecasts of the currency pairs worth watching. The first part of our forecast is based upon our research of the past 18 years of Forex prices, which show that the following methodologies have all produced profitable results:

- Trading the two currencies that are trending the most strongly over the past 3 months.

- Assuming that trends are usually ready to reverse after 12 months.

- Trading against very strong counter-trend movements by currency pairs made during the previous week.

- Buying currencies with high interest rates and selling currencies with low interest rates.

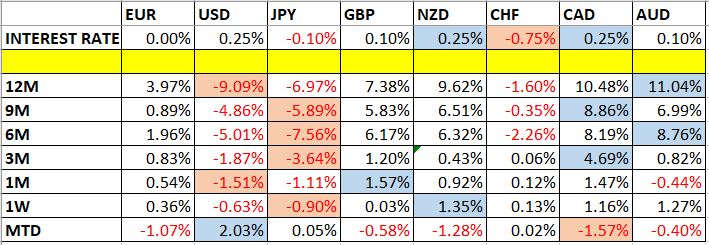

Let us look at the relevant data of currency price changes and interest rates to date, which we compiled using a trade-weighted index of the major global currencies:

Monthly Forecast June 2021

For the month of June, we forecasted that the USD/CAD currency pair would fall in value, and the CAD/JPY currency cross would rise in value. The performance of the forecast so far is shown below:

Weekly Forecast 27th June 2021

Last week, we made no weekly forecast, as there were no large counter-trend price movements in any important currency pairs or crosses.

We again make no forecast this week.

The Forex market saw its level of volatility remain roughly the same last week, as I forecasted, with 41% of the important currency pairs and crosses again moving by more than 1% in value. Volatility is likely to be lower over the coming week until Friday, when it may increase sharply due to the non-farm payrolls data release due then.

Last week was dominated by great relative strength in the New Zealand dollar, and relative weakness in the Japanese yen.

You can trade our forecasts in a real or demo Forex brokerage account.

Previous Monthly Forecasts

You can view the results of our previous monthly forecasts here.

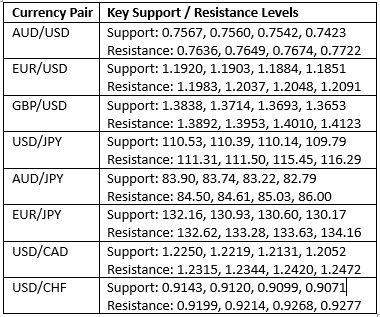

Key Support/Resistance Levels for Popular Pairs

We teach that trades should be entered and exited at or very close to key support and resistance levels. There are certain key support and resistance levels that can be watched on the more popular currency pairs this week.

Let us see how trading reversals from two of last week’s key levels would have worked out:

EUR/USD

We had expected the level at 1.1851 might act as support, as it had acted previously as both support and resistance. Note how these “flipping” levels can work well. The H1 chart below shows how the price rejected this level with a bullish engulfing candlestick during last Monday’s Asian session, marked by the up arrow in the price chart below. This trade has been very profitable due to the relatively strong price reversal seen last week, achieving a maximum positive reward to risk ratio of 5 to 1 based upon the size of the entry candlestick structure.

EUR/JPY

We had expected the level at 130.17 might act as support, as it had acted previously as both support and resistance. Note how these “flipping” levels can work well. The H1 chart below shows how the price rejected this level with a bullish engulfing candlestick during last Monday’s Asian session (typically a great time to be trading currency pairs with a major Asian currency component such as the EUR/JPY cross), marked by the up arrow in the price chart below. This trade has been very profitable due to the relatively strong price reversal seen last week, achieving a maximum positive reward to risk ratio of more than 8 to 1 based upon the size of the entry candlestick structure.