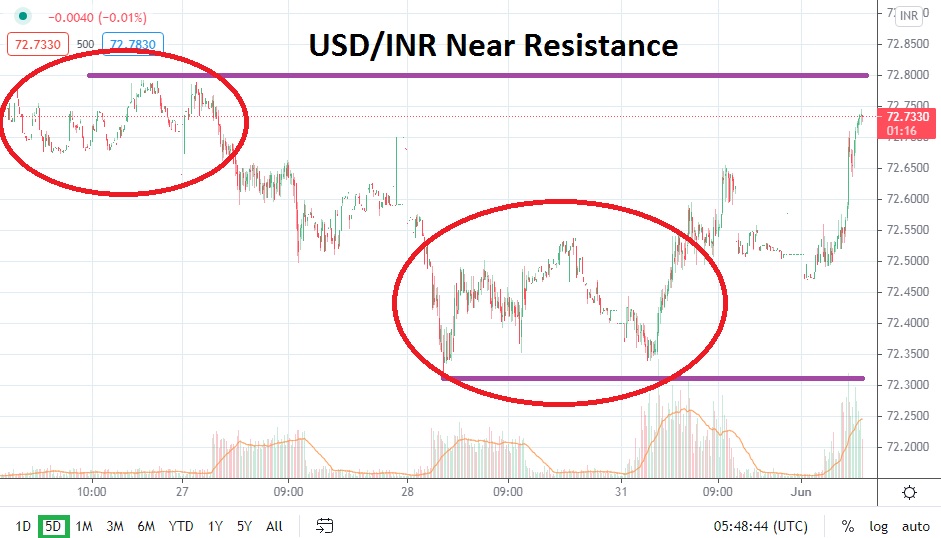

The USD/INR has reacted with a move higher, after touching important support levels late last week and yesterday. The 72.3300 support level was tested and the last time the USD/INR produced a significant amount of trading near this value was on the 23rd of March. Vital support remains rather adequate looking near the 72.2500 mark, having been approached in February and March briefly.

Significantly for short term traders however, will be the reversal higher which has been demonstrated this morning and has the USD/INR traversing near the 72.7500 level. Traders will have to decide if this move higher was a simple reaction to new lows being tested yesterday. Resistance near the 72.8000 could prove to be important and if this level proves to be durable traders may suspect another downturn will develop sooner rather than later.

The trend of the USD/INR has been bearish. The price recovery of the Indian Rupee since the height of April’s coronavirus fears has been strong and seemingly been digested regarding negative concerns. If a speculator wants to short the USD/INR near current resistance levels they can use rather tight stop losses as a protective measure. If the USD/INR is able to puncture resistance higher a test of the 72.9000 level is not out of the question.

Natural reversals and in particular reactions to strong trends are a healthy aspect of forex trading. The ability of the USD/INR to produce a rather solid reversal higher early today may prove to be an opportunity for speculators, if they believe technically the forex pair will remain within its bearish price range. Traders should not aim for the lower values achieved late last week or yesterday if they choose to be sellers of the USD/INR, aiming for closer support levels is encouraged.

Until proven otherwise, the USD/INR remains within a solid bearish value band. Traders who believe this morning’s reversal higher will soon erode and another leg lower will develop cannot be blamed. Speculators should be cautious regarding the amount of leverage they choose and not become too greedy, but shorting the USD/INR on slight reversals higher within its current price vicinity does look rather attractive.

Indian Rupee Short Term Outlook:

Current Resistance: 72.7900

Current Support: 72.5900

High Target: 72.9000

Low Target: 72.3300