The recent selling operations pushed the price of the USD/JPY currency pair to the 110.43 support level, which is stable, with the currency market anticipating important US job numbers.

Commenting on the performance of the dollar, Chris Beauchamp, chief market analyst at IG, said on the main global currency topic as the end of the month approaches: "The strength of the dollar is creating tremors in the markets." It appears that the dollar will end in June in an uptrend and is on its way to claiming it as the top performing major currency of the month, a performance that turns around given the declines that occurred during the year to June.

The US Federal Open Market Committee (FOMC) meeting in June saw policymakers signal that the first interest rate timing in the post-Covid era is likely to come in 2023, a shift from earlier expectations of a hike in 2024. Forex analysts at Goldman Sachs said they are sticking to the view that the US currency will eventually lose value in the coming weeks and months.

In a regular currency briefing, Goldman Sachs says they maintain the view that the long-term trend of the US dollar will remain bearish. However, they acknowledge that “the signal from the recent FOMC meeting has reduced the risk of a sharp dollar depreciation driven by higher inflation and lower real interest rates, and should lead to a clearer positive correlation between higher domestic inflation news and appreciation of the US dollar.” .

Goldman Sachs forecast the GBP/USD exchange rate at 1.36 in three months, 1.40 in six months and 1.42 in 12 months. The investment bank also expects the EUR/USD exchange rate to be at 1.20 in three months, 1.23 in six months, and 1.25 in twelve months.

On the economic side, US consumer confidence rose for a fifth month in June to the highest level since the pandemic began last year as households responded with increased vaccinations and businesses reopened. The US Consumer Confidence Index rose to 127.3 in June, up from May's reading of 120.0. The June increase reflected an improvement in consumers' assessment of current conditions. Consumer confidence is expected to continue rising in the coming months which will provide further support to consumer spending which accounts for 70% of economic activity.

Commenting on the results, Lynn Franco, senior director of economic indicators at the Conference Board, said: "Consumer optimism has rebounded in the short term, buoyed by expectations that business conditions and their financial outlook will continue to improve in the coming months." Franco also noted that despite the increase in short-term expectations about inflation, this had little effect on consumer confidence about buying expensive items. The proportion of consumers planning to buy homes, cars, and major appliances increased, as did the intention to take a vacation.

Consumers' assessment of current business conditions increased 24.5% of viewing conditions as good, up from 19.9% in May. Consumers' assessment of the labor market also rose, with 54.4% of consumers saying jobs were plentiful, up from 48.5% in May while 10.9% of consumers saw jobs hard, down from 11.6% in May.

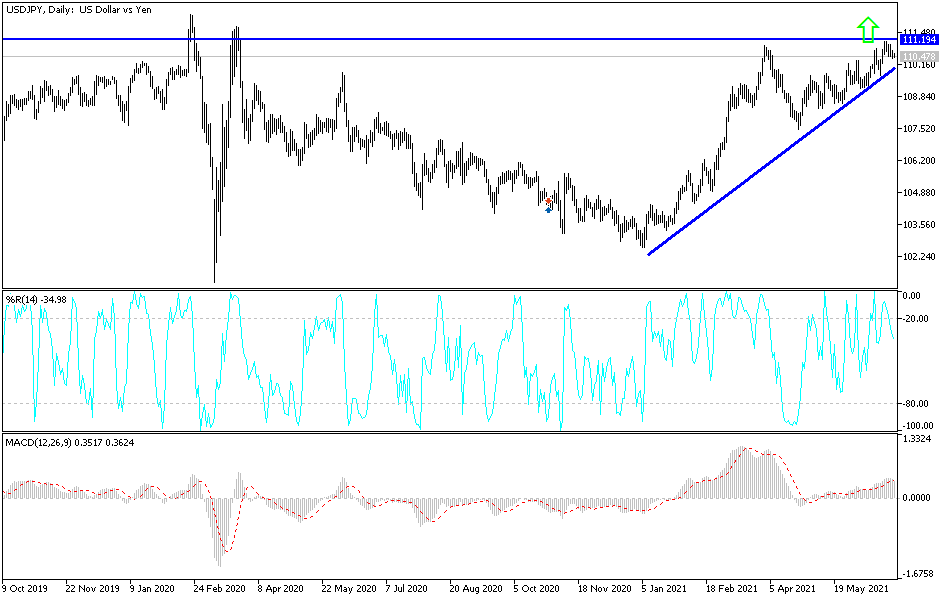

According to the technical analysis of the pair: So far, the general trend of the USD/JPY currency pair is still bullish despite the recent performance as long as it is stable above the 110.00 psychological resistance. There will be no reversal of the current trend without the bears moving in the currency pair towards the support levels 109.75 and 108.90, respectively. Currently, the closest targets for the bulls are 110.85, 111.20 and 112.00. The US dollar's current gains will depend on the market's reaction to the announcement of the upcoming US data, especially the US jobs numbers. Today, the ADP survey of the change in the number of US non-farm payrolls and the PMI reading from Chicago will be announced.