The USD/JPY may continue to move in a narrow and limited range until the release of US inflation figures, the most powerful factor affecting the performance of the US dollar in the Forex market this week. Since the beginning of the week's trading, the currency pair has been stable between the support level of 109.18 and the level of 109.55 and is stable around the level of 109.45 at the time of writing. The dollar is still under pressure from investors' disappointment with the US jobs report for the month of May. It may witness more movement if the US inflation numbers come in stronger than expected, because it will increase market expectations of the imminent tightening the US Federal Reserve's policy.

US employers posted a record 9.3 million jobs in April as the US economy reopened at breakneck speed. Accordingly, the number of US job vacancies rose by 12% from the 8.3 million that were counted in March. But employers hired just 6.1 million, up 1% from March, according to a Labor Department report yesterday, indicating that jobs are opening faster than companies can fill them.

Commenting on the figures, Job Lab Director Nick Bunker said, “More than a year after horrific job losses and wage cuts, job seekers have a strong hand in the job market once again. He added that the demand for workers is rising as the economy begins to emerge from the restrictions of the epidemic. Meanwhile, supply is restricted because workers are slow to find their normal post-pandemic situation. The result is that the job market is once again recovering faster than many expected.”

Hotels and restaurants, which have reopened after being forced to close or limit opening hours during the COVID-19 coronavirus pandemic, have registered the largest increase in employment. The number of Americans who left their jobs rose 11% to nearly 4 million in April, the highest number in records going back to 2000.

By the end of last week, the Labor Department reported that the US economy created 559,000 new jobs in May and that the country's unemployment rate fell to 5.8% from 6.1% in April. Employment figures are usually seen as exceptional. But with the economy recovering from the coronavirus recession, some economists expected much faster job gains. The United States still lacks 7.6 million jobs than in February 2020.

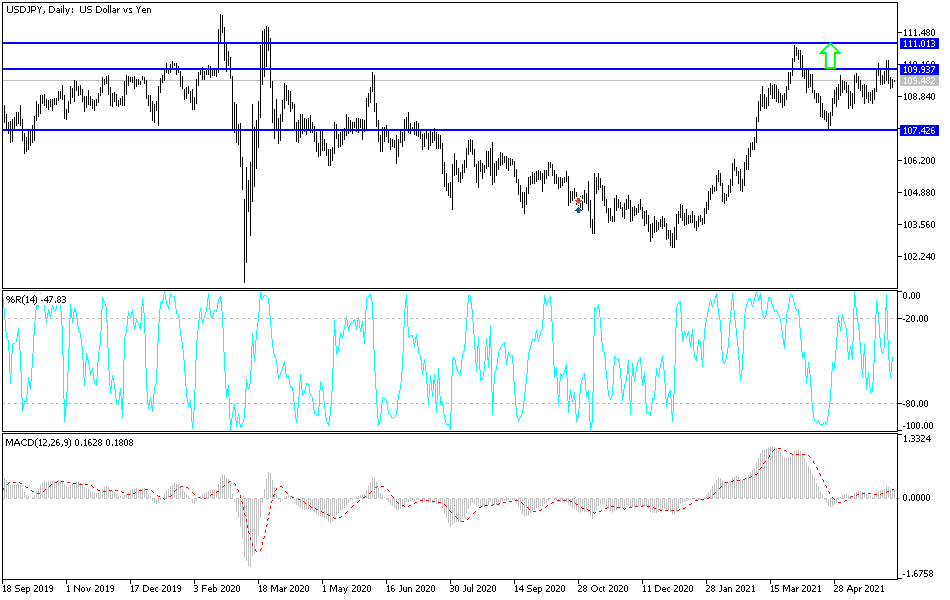

Technical analysis of the pair:

There is no change in performance and movement, so no change in the technical outlook. As I mentioned recently, the 110.00 psychological resistance will remain the most important for bulls, because it motivates Forex traders to buy, and thus move towards stronger upward levels. With the dollar losing momentum, the pair may have the opportunity to move towards the support levels 109.00 and 108.55 until the US inflation numbers are announced. I still prefer buying the currency pair from every dip.