For three trading sessions in a row, selloffs in the USD/JPY pair pushed it towards the 109.18 support level before settling around the 109.25 level at the beginning Tuesday's trading. The setback of the US jobs report stopped attempts to rebound higher at the resistance level of 110.32. In general, the Japanese yen is exposed to a state of instability in the Forex market due to slow Japanese vaccinations against the coronavirus, compared to other global economies.

The Japanese companies sponsoring the Olympics called for the games to be postponed in order to accelerate vaccinations. A decision on domestic spectators is expected around June 24. However, as vaccinations increase and athletes begin to arrive, the fait accompli, and opposition to holding the Games, may wane. A Yomiuri poll found that 50% now say the Olympics should go ahead, up from 39% last month. Also, a separate TBS survey found that 44% favor the Olympics, up from 35% in May. However, this doesn't seem to have helped Japanese Prime Minister Suga much. In both polls, his support is at its lowest since he replaced Abe last September.

US Treasury Secretary Janet Yellen said that President Joe Biden's spending plan would be good for the economy, even if it led to higher inflation in the country. Yellen said in an interview with Bloomberg News that the president's $4 trillion spending plan is positive for the economy, even though it stimulates inflation that continues into 2022.

Yellen added that a "slightly higher" interest rate environment would be an advantage.

This week, investors are waiting for key US inflation data to get more indications about the Fed's policy outlook. Overall, more than a year after the coronavirus caused the largest economic recession and job losses ever, the speed of the recovery has been so unexpectedly fast that many companies cannot fill jobs or get enough supplies to meet a pent-up wave of customer demand.

US employers added 559,000 jobs last month, above 278,000 in April. These numbers are usually seen as perfectly healthy numbers. However, on the back of record job vacancies and consumers enjoying free spending, analysts expected more hiring. Some economists had envisaged recovering from the pandemic recession leading to monthly job growth of 800,000, 900,000, or even a million or more.

Global financial markets suffered an unwelcome jolt last month when the Labor Department reported that US consumer prices jumped 0.8% from March to April and 4.2% from the 12 months prior - the largest year-on-year increase since 2008.

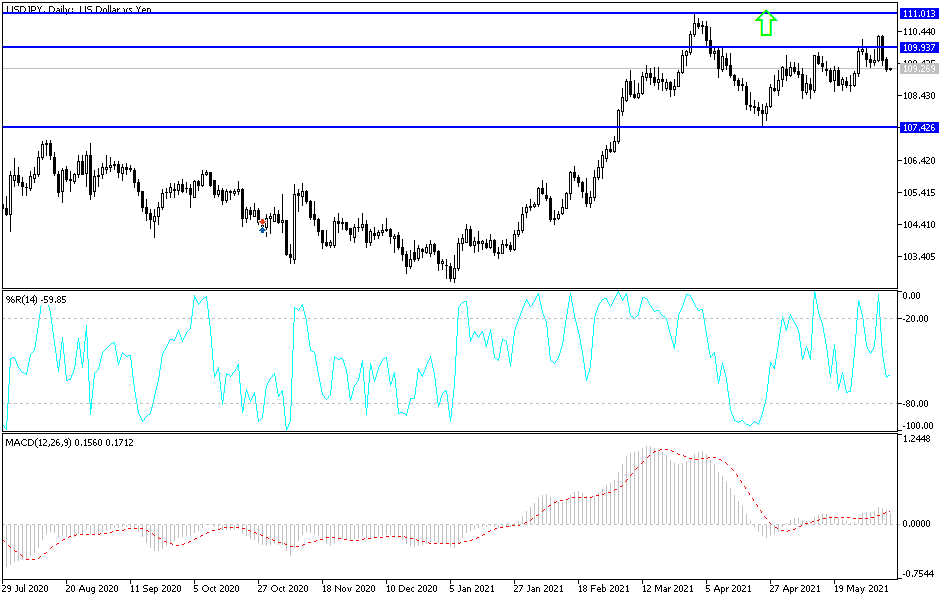

Technical analysis of the pair:

I still see that the psychological resistance level of 110.00 is the most important for any bullish correction of the USD/JPY currency pair, because it may technically stimulate more buying operations for the pair. The current correction track awaits the break through this resistance, as happened last week. On the other hand, there will be a return to the bears' control over performance if the currency pair moves below the 108.80 support level again. All in all, I still prefer buying the currency pair from every dip.

From Japan, the GDP growth rate and current accounts numbers will be announced, and from the United States of America, the trade balance numbers will be announced.