This is due to fears of a collapse of the Japanese economy because of the outbreak of Corona and the poor vaccination against it.

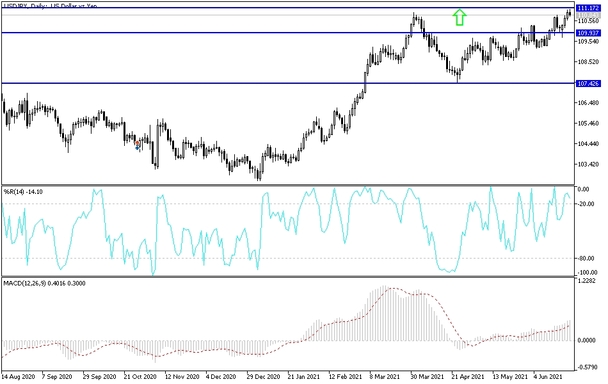

This contributed to pushing the price of the US dollar against the Japanese yen to the resistance level 111.11, its highest level in 15 months, before settling around the level of 110.85 before announcing the US GDP growth rate.

Last week's update saw the majority of Fed rate setters indicate that they now individually expect a vote on a US rate hike before the end of 2023. This is also with a significant minority in the FOMC to see a potential case move sooner. Bank Governor Powell downplayed the so-called bullet plot of the outlook at a press conference after the announcement.

The suggestion that interest rate hikes in 2022 and 2023 were in any way against the previous Fed's guidance, but came after a string of stronger-than-expected inflation numbers, the market is leading to suspect the seemingly growing proximity of a Fed policy change, either this week or later, which could put a lid on the dollar.

Treasury Secretary Janet Yellen told a congressional committee on Wednesday that failure to raise the federal debt ceiling would have "serious consequences" that could lead to a financial crisis. In her testimony before the Senate Appropriations Subcommittee, Yellen said in response to questions that it is important that Congress not delay in dealing with the debt limit, which has been suspended for the past two years.

This suspension is due to expire on July 31, when the limit will come into effect on the debt level at that time. The debt ceiling currently stands at $28.3 trillion. It has risen sharply over the past year as Congress approved trillions of dollars in support packages to combat the recession caused by the COVID-19 pandemic. Democratic Senator Chris Van Hollen asked what would happen if Congress failed to raise the debt ceiling or suspend it for a while so the government can continue to borrow to meet its obligations, including making interest payments on the national debt.

Failure to make these debt payments will result in the federal government defaulting on its debt obligations, something that has never happened in US history. The standoff over raising the debt ceiling in 2011 led to the first-ever credit rating downgrade of a portion of the federal government's AAA bond rating by Standard & Poor's.

USD/JPY technical analysis: The general trend of the USD/JPY currency pair is still bullish, and at the same time, stability around and above the resistance 111.00 may push the technical indicators to overbought levels. This is expected to sell profit-taking unless the dollar gets more momentum to complete the current trend. On the downside, the bears will not return to performance without moving towards the 109.70 support level as a first stage. Today, the US dollar will be affected against other currencies by the announcement of the GDP growth rate, the number of weekly jobless claims and US durable goods orders.