The recent US jobs data did not provide the USD/JPY pair with enough momentum to go higher than the 110.32 resistance level, a 2-month high. The pair declined to the 109.36 support level before settling around the level of 109.52 with the closing of last week's trading. The US dollar fell against the euro, sterling and other major currencies after the release of a smaller-than-expected batch of labor market statistics from the United States of America. The US non-farm payroll report for May revealed that the US economy succeeded in creating 559 thousand jobs, with more than 278 thousand created in April but less than expectations of 650 thousand.

Commenting on the performance, Derek Halpenny, head of research and global markets at MUFG, said: "The US dollar was having a good week and before the US jobs report it had advanced against all the G10 currencies." Joe Manimbo, senior market analyst at Western Union, said: "The US dollar has fallen from its highest levels in three weeks after employment accelerated less than expected last month."

"The disappointing US employment gain was largely driven by growth in the leisure and hospitality industry, while average wages rose 0.5% in the month as employers tried to attract workers," said Catherine Judge, chief economist at CIBC Capital Markets.

However, the US unemployment rate unexpectedly fell to 5.8%, supported by a slight drop in the participation rate. Overall, employment reports have become increasingly important to investors in 2021 due to the Fed's assurance that it will not reduce its quantitative easing program (tapering) until more jobs are created. Meanwhile, scaling back the quantitative easing program is a prerequisite for a rate hike, which in turn is a driver of the dollar's strength.

Any meaningful strength in the dollar is likely to arrive only when the Fed says it feels confident enough to start changing its approach. Currently, economists are assessing why the US economy is not creating more jobs at this stage of the recovery, especially since the COVID-19 crisis appears to have largely passed and there are very few restrictions still in place.

From Japan, total household spending for April exceeded the expected change (on an annual basis) by 9.3% with a record of 13%. Prior to that, the preliminary industrial production rate for April outperformed the expected 9-year change YoY at 3.5% with a 15% .4.

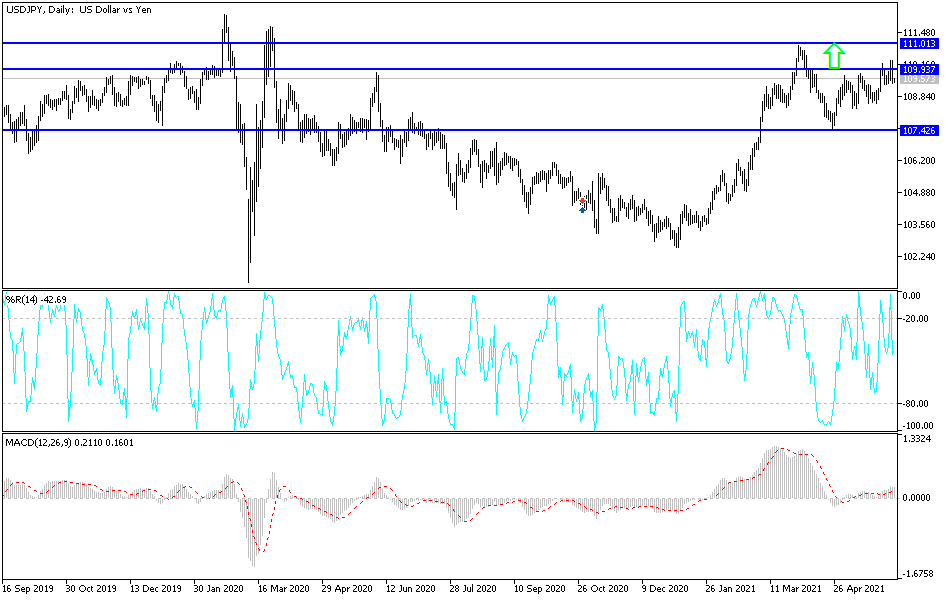

Technical analysis of the pair:

In the near term, according to the performance on the hourly chart, it appears that the USD/JPY currency pair is trading within a rising wedge formation. The pair recently declined to trade at the 109.48 support. It is now in oversold areas of the 14 hour RSI. This may lead to a short-term recovery. Accordingly, the bulls will look to make correction profits at around 109.70 or higher at 109.95. On the other hand, bears will look to take advantage of pullbacks around the 109.32 support or lower at the 109.05 support.

In the long term, according to the performance on the daily chart, it appears that the USD/JPY is trading within the formation of a sharp bullish channel. The pair has now risen near the overbought levels of the 14-day RSI. This shows a strong bullish bias in market sentiment. Accordingly, the bulls will look to ride the current rally by targeting profits at around 110.19 or higher at 111.06. On the other hand, the bears will look to pounce on potential pullbacks by targeting profits around 108.73 or lower at the 107.70 support.

The USD/JPY currency pair is not a anticipating any important economic data from Japan or the United States. Accordingly, investor risk sentiment or lack thereof will have an impact on the currency pair's performance today.