The US economic improvement from the effects of the pandemic, along with hawkish statements from US Federal Reserve officials led by Jerome Powell, will continue to support the strength of the US dollar against the rest of the other major currencies.

US Federal Reserve Governor Jerome Powell noted that the economy has shown sustained improvement since he last appeared before the committee, citing widespread Covid-19 vaccinations as well as unprecedented monetary and fiscal policy measures. Powell added, "Indicators of economic activity and employment continued to strengthen, and it appears that this year's real GDP is on track to record its fastest rate of increase in decades." "A lot of this rapid growth reflects the continued recovery of activity from recessionary levels," he added. “The sectors most affected by the epidemic are still weak, but they have shown improvement.”

Powell also said that labor market conditions have continued to improve along with general economic activity, although he noted that the pace has been uneven. The unemployment rate of 5.8 percent in May reduces the shortage of employment, especially since participation in the labor market has not risen from the low rates that prevailed for most of last year.

He also said, "Job gains will rebound in the coming months with increased vaccinations, relieving some of the factors associated with the epidemic that are currently burdening them."

At the same time, Powell acknowledged that US inflation had risen significantly in recent months but reiterated the view that the jump was due to "transitional" factors and predicted inflation would fall back toward the Fed's long-term target of 2% price growth. The Federal Reserve Chairman warned that the COVID-19 coronavirus pandemic continues to pose risks to the economic outlook, noting the slowing pace of vaccinations and new strains of the virus.

Powell stressed that the Fed will do "everything in its power to support the economy for as long as it takes to complete the recovery."

Powell's testimony comes after the latest forecast from the Federal Reserve indicated an interest rate increase in 2023. The latest forecast from Federal Reserve officials, released last Wednesday, indicates that US interest rates will rise to 0.6 percent in 2023.

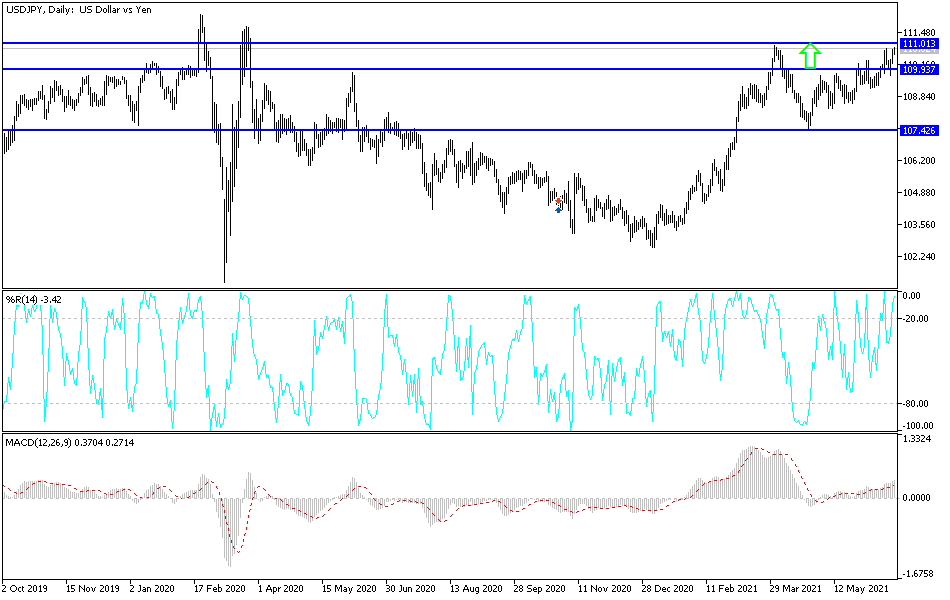

According to the technical analysis of the pair: It is confirmed now that the stability of the USD/JPY currency pair above the 110.00 psychological resistance will continue to support the upward trend and stimulate more purchases. The recent gains have moved the technical indicators to overbought levels, and unless the pair gains more momentum, profit-taking may be triggered at any time. So far, the general trend of the pair is still bullish and the nearest resistance levels are 111.20 and 112.00, respectively. The pair's trends will be affected today by the announcement of the PMI readings for the US manufacturing and services sectors, in addition to US new home sales and statements by some US Federal Reserve officials.

The bearish turn for the dollar-yen pair needs to breach the support levels 110.20, 109.60 and 108.80, respectively.