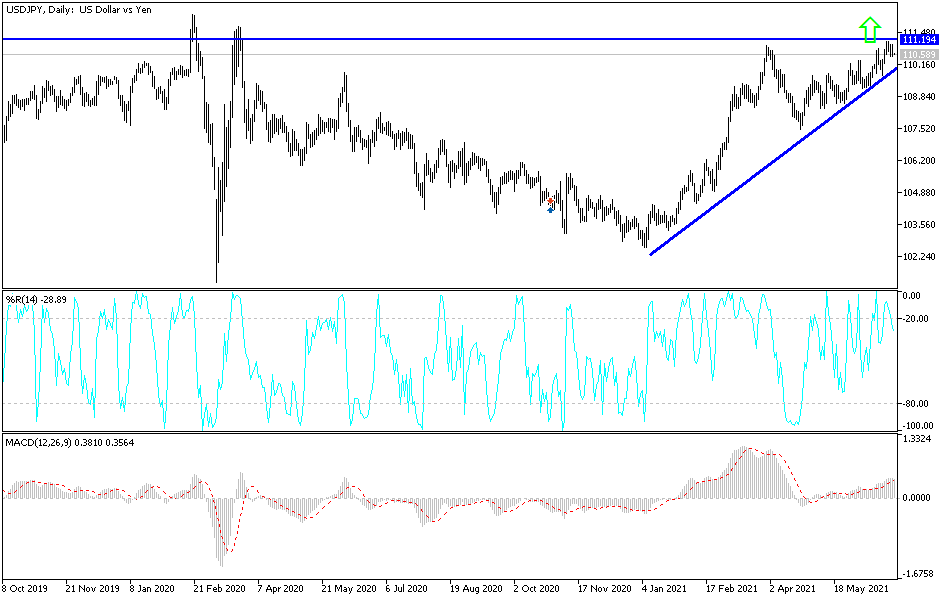

For four trading sessions in a row, the USD/JPY currency pair is subjected to selling operations that pushed it towards the 110.50 support level, which is stable near it. I see that the correction was not strong, and the trend is still bullish. The last move is normal after the pair reached the resistance level 111.11, its highest since March of 2020. The US dollar is still the strongest against the rest of the other major currencies amid expectations of imminent tightening of monetary policy by the Federal Reserve.

The Japanese yen rose against most currencies recently, as concerns about an increase in coronavirus cases across the region outweighed optimism about an economic recovery. Sydney, Australia's largest city, moved into a two-week lockdown on Saturday over fears of cases of the variable delta virus.

Japanese Prime Minister Yoshihide Suga said that the government is on high alert after the infection escalated in the Tokyo region. Malaysia will extend the closure that was due to expire yesterday. Thailand has imposed strict lockdown measures in the capital, Bangkok, and other provinces as current restrictions have not been able to prevent the spread of the coronavirus.

China's industrial profits slowed again in May due to higher fundamental effects and increases in production costs.

At its monetary policy meeting on June 17-18, policy makers at the Bank of Japan said that inflation in Japan is likely to pick up in the second half of 2021 as demand begins to pent up. According to the summary of opinions, inflation is expected to reach around zero percent in the short term. Inflation is expected to rise gradually, mainly due to continued improvement in economic activity, higher energy prices, and dissipating the effects of lower mobile phone charges. However, inflationary pressure is only expected to be temporary due to a well-established deflationary mindset.

Also, one member said that vaccinations are progressing rapidly recently, and the Japanese economy is expected to recover somewhat in the short term.

Japanese Prime Minister Yoshihide Suga pledged to strengthen health controls at airports after a member of the Ugandan Olympic team tested positive for COVID-19 in the city hosting their training camp. This is raising fears that the upcoming games will spread the infection. Experts have noted a significant increase in the movement of people in Tokyo and other urban areas since the state of emergency was eased on June 21 and warned of signs of a resurgence of infections in the Tokyo area.

On Monday, Tokyo recorded 317 new cases, up from 236 from the previous week, and the ninth consecutive day of increases on a weekly basis, with an increase in delta variant cases. Experts said that could speed up a return to levels that would require another emergency during the Olympics.

USD/JPY technical analysis: On the daily time frame, the stability of the USD/JPY currency pair is still above the 110.00 psychological resistance, which still supports the strength of the current bullish trend. There will be no actual change in the trend without breaching the support levels 109.70 and 108.80, respectively. The closest targets for the bulls are currently 110.85, 111.20 and 112.00, respectively. The second and third levels may push the technical indicators to overbought levels.

The US dollar is still reaping gains from expectations of raising US interest rates with the announcement of US jobs numbers by the end of the week. Before this can happen, the announcement of US consumer confidence today will be affected. The ADP readings to measure the change in non-farm jobs and jobless claims before the event Friday is most important.