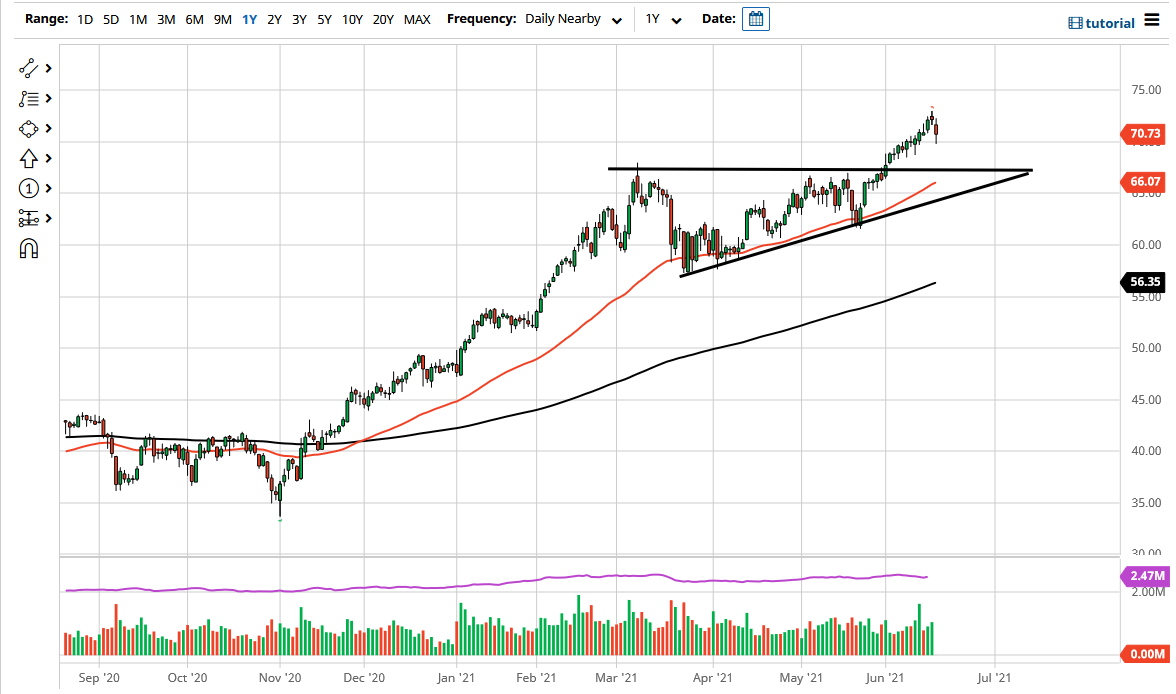

The West Texas Intermediate Crude Oil market broke down a bit during the trading session on Thursday as we continue to see a lot of noise and fallout from the Federal Reserve announcement on Wednesday. The market has certainly overreacted in a lot of different ways, so at this point in time I think that a lot of the longer-term traders will be looking at this as a potential gift, as the overall cyclical trade is still to the upside.

It is worth noting that the $70 level has held, so that shows that there is a certain amount of buying pressure underneath still. After all, if we are going to break down quite drastically, stands to reason that the $70 level would not have been important enough the buyers in. Furthermore, I think that the market continues to see a lot of noisy behavior, and the value hunters will have loved what just happened. Even if we break down below here, I see even more support at the $67.50 level.

As we have seen as of late, the oil market of course is on fire and demand will almost certainly pick up for crude. With this being the case, I think that a lot of the bigger fonts are jumping into the market to pick up oil as the most likely of targets is going to be closer to the $75 level, perhaps even $77.50 level based upon the size of the triangle. I think we continue to be buyers of dips going forward, especially with the 50 day EMA now approaching the top of the triangle.

In fact, I have no scenario in which I am willing to short this market anytime soon, unless of course we see some type of major shift in attitude. While the bloodbath and a lot of markets of the last couple of days has certainly cause some headaches, it still has not changed major trends. We would need to see the uptrend line of the ascending triangle broken down below in order to get short, so I think at this point in time it is almost impossible to fight this overall trend. With that, I believe that crude oil will continue to climb much higher over the next several weeks.