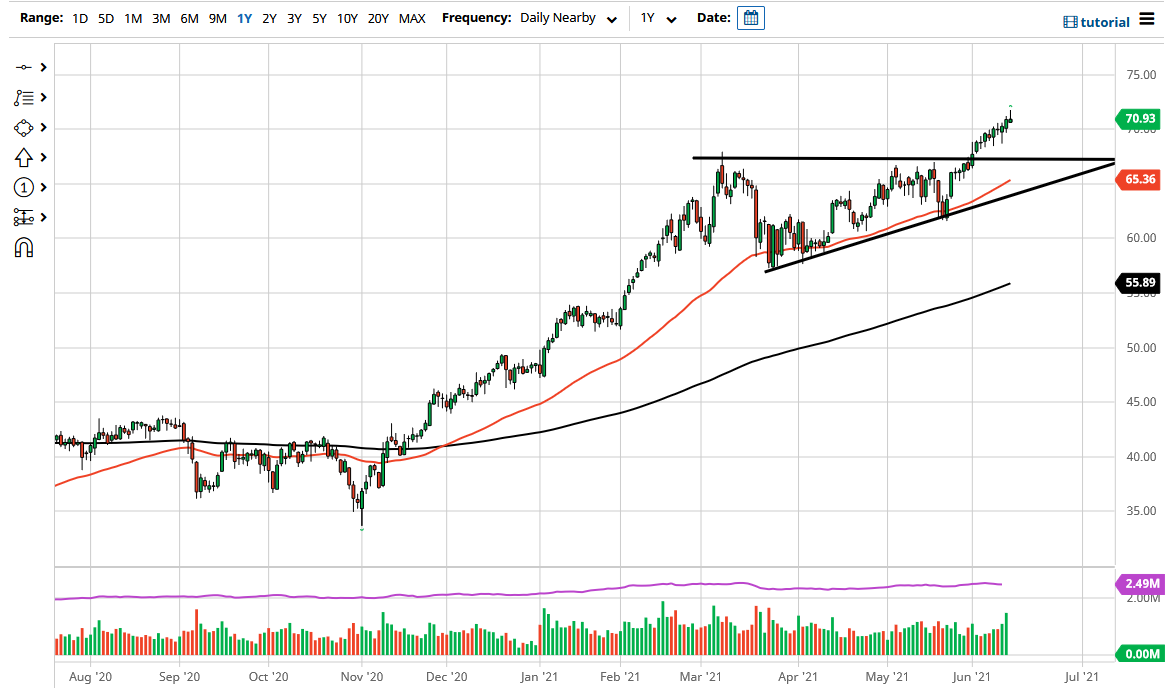

The West Texas Intermediate Crude Oil market has shown itself to be bullish yet again but gave back some of the gains to show a little bit of hesitancy. Nonetheless, there is a lot of support underneath that I think comes into play, and I would be a buyer of this market when we get a little bit of value coming into the market. The $70 level is very important because it is a large, round, psychologically significant figure that a lot of people will react to, but then again, we also have even more support underneath.

Looking at the candlestick, the market did pull back a bit in order to form a shooting star, as the market has run into a bit of exhaustion. That being the case, the market is likely to continue to see noisy behavior and, as a result, it is likely that the pullback will be looked at as a potential buying opportunity. That being said, the market should continue to see plenty of people getting involved that were not able to previously, especially at the top of the ascending triangle, which sits at the $67.50 level. The 50-day EMA is starting to reach towards that area as well, so it makes sense that we should find buyers on any dip. If we break above the top of the candlestick for the trading session on Monday, that will also show a surge in bullish pressure and should open up the possibility of a move towards the $75 level.

After that, we could go as high as the $80 level, but I think that is a longer-term target, and I think it is going to take a while to get there. Eventually, probably by the end of the summer, I think we will touch the $80 level. It does not necessarily mean that we are going to go straight up in the air like we had previously, and I do not think that is the most likely of outcomes. I believe we will simply continue to grind higher on short-term pullbacks, so that is essentially how I am going to be playing this market. With this, I have no interest in shorting, but I do like the idea of buying these dips for short-term trades to the upside.