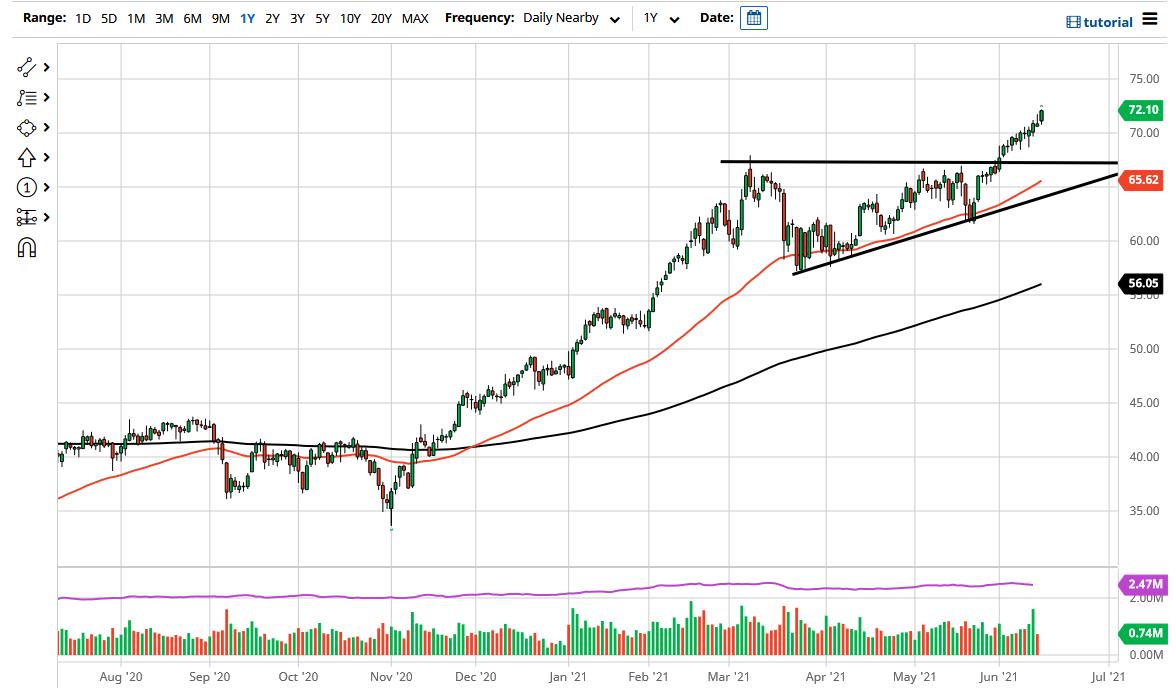

The West Texas Intermediate Crude Oil market rallied a bit during the trading session on Tuesday as we continue to see crude oil outperform most other commodities. In fact, I think the crude oil market is going to continue to shoot straight up in the air, and at this point I like the idea of buying short-term pullbacks in order to take advantage of value. I believe that the $70 level underneath is going to be a short-term support level, as it is a large, round, psychologically significant figure.

Even below the $70 level, I think there is a significant amount of support where the support gets even stronger, namely at the $67.50 level. This is the top of the recent ascending triangle, which shows a significant amount of bullish attitude going forward. The 50-day EMA is sloping higher and showing the bottom of the triangle as being supportive as well. In fact, the market is one that cannot be shorted anytime soon, as the technicals all line up for a positive move to the upside.

The reopening of the world’s largest economies continues to be the main driver of where we are going, but it is worth noting that the Federal Reserve has a meeting on Wednesday, which obviously would come into the picture as far as influence is concerned and could cause volatility later in the session. It is likely to have an effect on the greenback, which the commodity is priced in. The oil markets have been very bullish for quite some time, and although I think that we are later in the uptrend, the reality is that we are still very much in an uptrend. Based upon the triangle, I think that we will go looking towards the $75 level, and then eventually the $77.50 level, as the measured move suggests that we are ready to go towards that area.

It is not until we break down below the uptrend line of the ascending triangle that I would be even remotely interested in shorting this market, which does not look likely to happen in the foreseeable future. I look at pullbacks as a potential buying opportunity, as demand for crude oil has managed to wipe up a lot of the glut that happened after the pandemic.