The West Texas Intermediate Crude Oil market initially pulled back a bit during the trading session on Friday, but saw quite a bit of a turnaround as the jobs number came out with 559,000 jobs for the previous month. There was a lot of concern on Thursday about the possibility of the Federal Reserve tapering, at least as far as the quantitative easing situation is concerned, due to the fact that the ADP private numbers were so hot. That being said, there were whispers of “1 million jobs added” going around the trading floors.

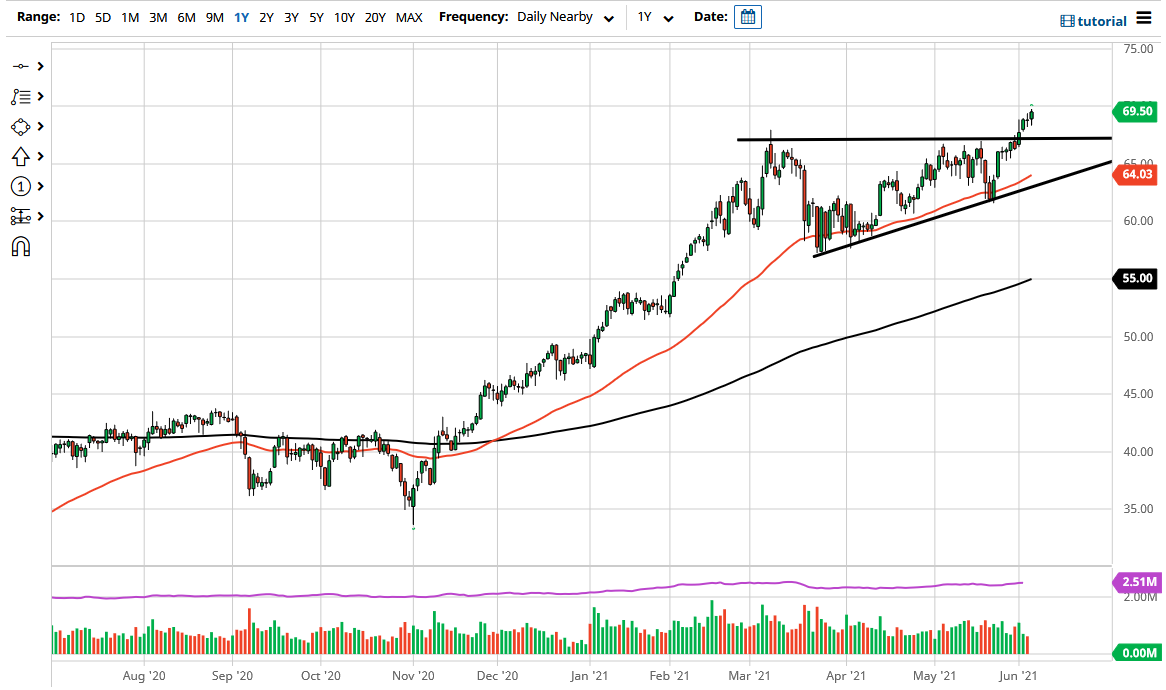

To the downside, the $67.50 level should be supportive, as it was significant resistance. Ultimately, the situation should continue to see a lot of noise in that area, as it is the top of the ascending triangle. Therefore, a lot of people will be paying close attention to it due to “market memory” and a potential retest of that area. I think that the market could go as high as $75 based upon the “measured move” of the ascending triangle, so I think that is where we are going given enough time.

I look at this market through the prism of finding value as there should be more demand for crude oil, and the market is also paying close attention to the OPEC forecasts for an increase of 6 million barrels demand per day for the rest of the year, and then the following US dollar helps push prices higher as well. In fact, I do not really have a scenario in which I would be selling oil at this point, unless we were to suddenly turn around and see some type of crash through the 50-day EMA and the uptrend line that sits underneath it. I do not know what would cause that, but obviously it would be a major shift in attitude, so you have to stand up and take notice of such a move. In that scenario, we could probably go looking towards the 200-day EMA. I continue to buy on the dips and build up a position going forward, as it looks like the inflation play is still very much intact, which helps most commodities, not just the oil market.