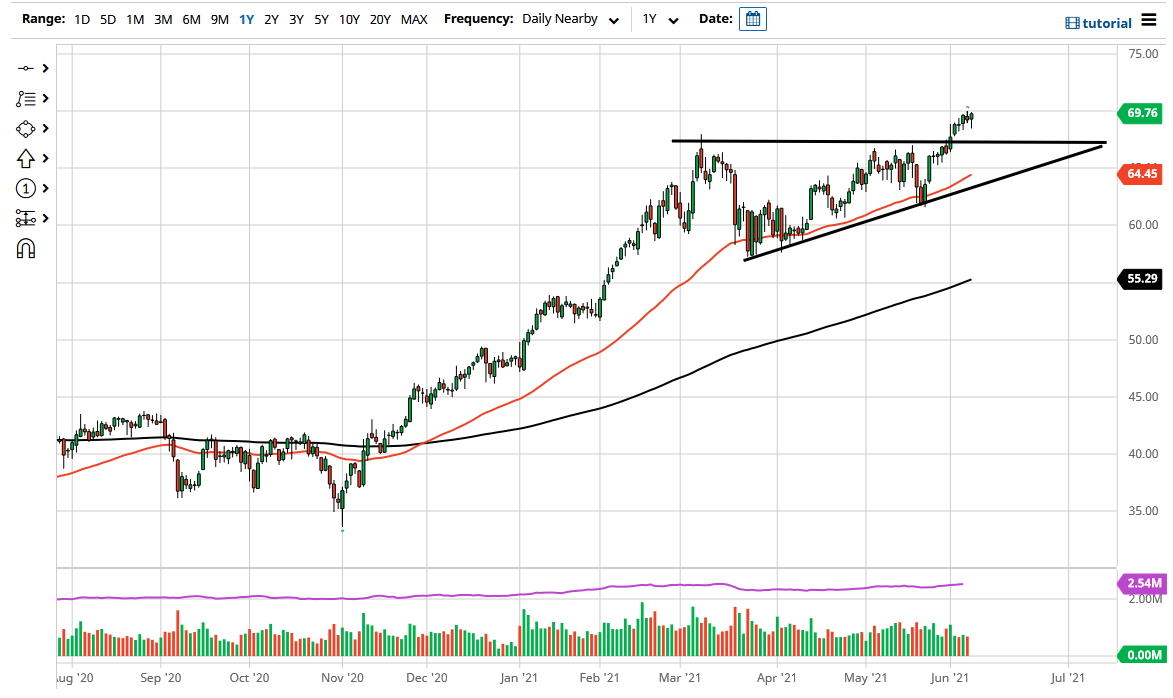

The West Texas Intermediate Crude Oil market initially pulled back during the trading session on Tuesday but then turned around to show signs of life again. By doing so, the market has shown its proclivity to continue going higher, so I still like the idea of buying dips. In fact, I think that we have support all the way down to the $67.50 level at the very least, as it is the top of the ascending triangle that we have just recently broken out of.

Yes, the $70 level above is going to cause some issues, but it is clear that we are trying to stay positive and eventually break above it. Once we get above the $70 level, it is very likely that we will go looking towards the $72.50 level, and then eventually the $75 level. At this point, the market looks likely to continue to grind its way to the upside and offer plenty of buying opportunities on short-term dips. The market more than likely will be a “buy on the dips” type of situation, as traders are betting on the idea of energy demand continuing to go higher, as the economies around the world continue to open up.

As you can see, the market continues to show plenty of bullish sentiment, and the fact that we have been stretched a bit does not seem to be affecting the attitude of the market. Furthermore, the candle is closing at the very top of the range, so that does signal some type of continuation. At this point, it looks like there are plenty of buyers looking to take advantage of value every time it occurs.

If we were to break down below the $67.50 level, then it is possible that we could go looking towards the $65 level, where the 50-day EMA is reaching towards and sloping to the upside. I think it is more than likely going to be difficult to fall there, but if we do see some type of push to the downside, I think that there should be plenty of people trying to take advantage of the significant uptrend that we have been in for quite some time. At this juncture, I do not have any interest in shorting crude oil.