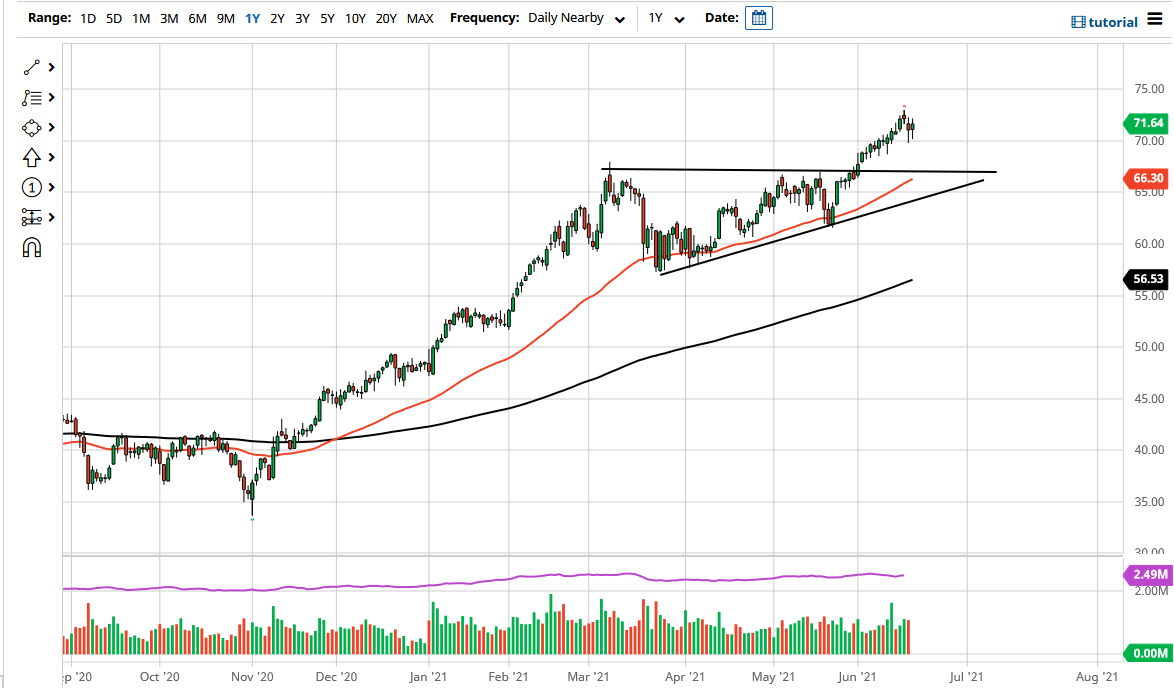

The West Texas Intermediate Crude Oil market initially pulled back during the trading session on Friday again, but just as we had seen on Thursday, buyers came back in near the $70 level to lift it. I think at this point it does make sense that the market will rally due to the fact that demand should be picking up. The fact that the US dollar strengthened hardly seems to have made any difference, and I believe that suggests that we are going to go higher one way or another.

To the downside, I see the $67.50 level as significant support, especially as it was the top of an ascending triangle that was so important before. Because of this, I would be very surprised if we break down below there, and if we did, it could put the uptrend overall in serious danger. The 50-day EMA is also sitting in that same area, so it makes sense that it should offer a bit of support as well. With all of that, I find that to be the “floor in the market” at the moment.

To the upside, I think the $72.50 level is worth paying attention to, as it is the most recent high, and breaking above there opens up the possibility of a move towards the $75 level which is the next psychologically important figure. Based upon the measured move of the triangle, we could be looking at a move towards the $77.50 level, but I think it is probably going to take a little while to get to.

It is very likely that we would see this market grind sideways more than anything else over the last couple of days due to the fact that we have gotten so far ahead of ourselves. We are bit stretched, so the market grinding sideways makes sense, especially as everybody else seems to be freaking out; it is a bit of a perfect scenario. As demand picks up due to reopening, we will continue to see oil be a positive market going forward, so I look at short-term pullbacks to show signs of support as potential value plays that I can be taking.