The West Texas Intermediate Crude Oil market gapped higher to kick off the trading session on Wednesday as we continue to see the market reach towards the upside, as demand for crude continues to pick up around the world. After all, with the global economy reopening, it makes sense that the crude oil demand would start to rally and strengthen going forward, and the US dollar has been softening in general, which drives up the value of crude oil, as it takes more of those greenbacks in order to buy a barrel.

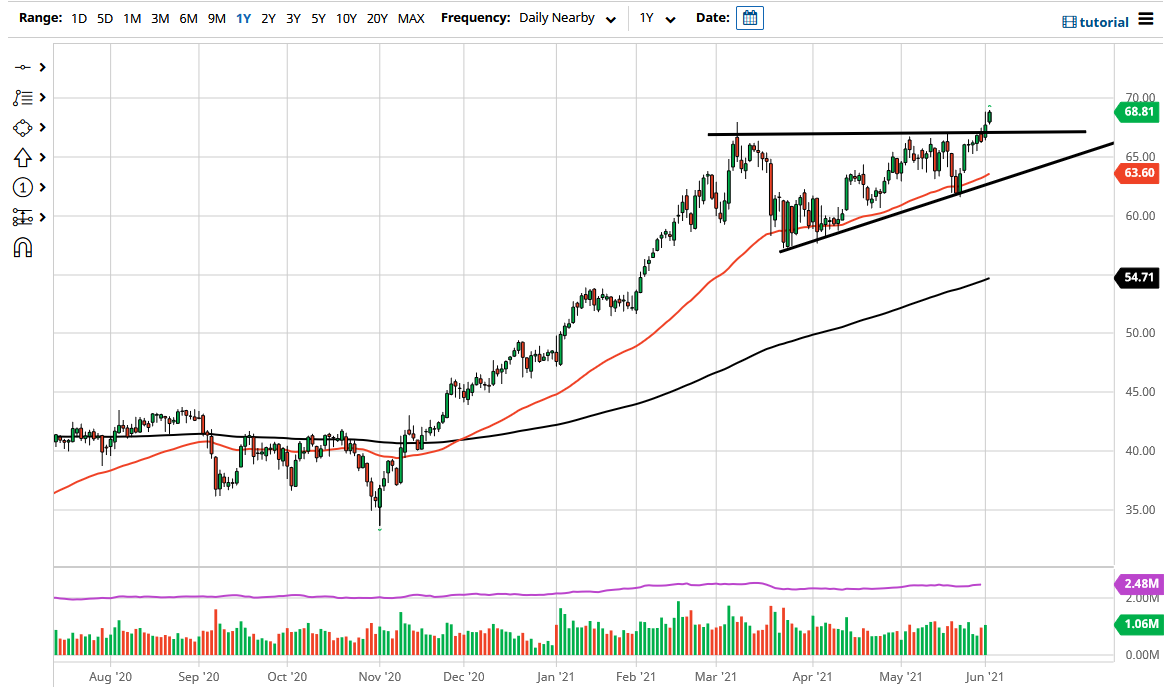

To the downside, I believe that the $67.50 level should be supportive, as it was previous resistance. By pulling back to that area, I believe that a lot of “market memory” will continue to come into play, and a lot of people will be looking to pick up “value” on the retest of the move. To the upside, the $70 level will be a target, and an area where a lot of people will be interested in trading. If we can break above there, then it is obvious that the market would go looking towards the $75 level.

When you look at the ascending triangle, it is roughly $10 tall, and it is likely that we could go looking towards $77.50 given enough time. Another thing to pay close attention to is that the 50-day EMA is offering support underneath as it walks along the uptrend line. I do think that it is only a matter of time before buyers would come in on any dip, but after the last 48 hours, it does not look likely that we are going to fall apart.

OPEC has reiterated its suggestion that there should be a lot of demand for crude oil, so it does make sense that we could go higher. We have rallied a bit the last couple of days so I would look for short-term pullbacks in order to get involved. Most certainly, we have a lot of momentum in this market that is to the upside and should continue as we have seen so much of that in the past.