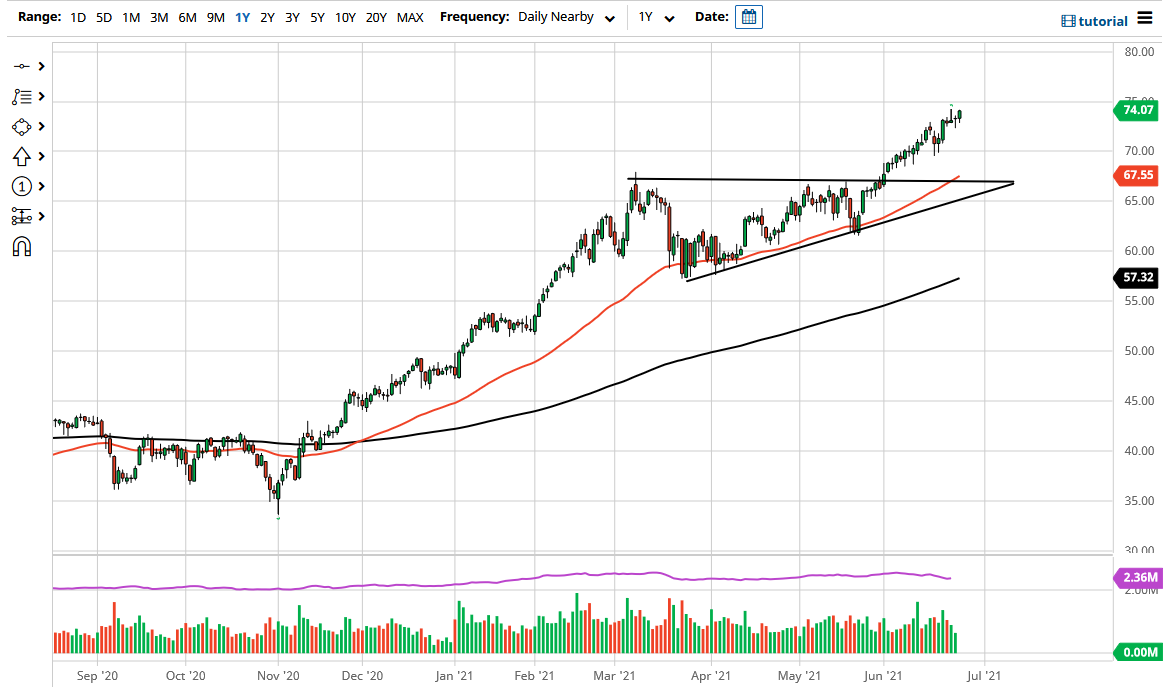

The West Texas Intermediate Crude Oil market pulled back just a bit during the trading session on Friday to kick off the session, only to turn around and show signs of strength. At this point, the market is likely to go looking towards the $75 level, which is an area that is a large, round, psychologically significant figure. With that in mind, we may see a little bit of a pushback in this general vicinity, but ultimately, I think that we will go higher due to a multitude of reasons.

When you look at this chart, you can see that we have already pulled back to test the $70 level, so that is the first major support level that I see underneath if we do get a bit of a pullback. After that, I believe that the 50-day EMA and the $67.50 level will come into the picture as support as well, as it was the top of a previous ascending triangle. Speaking of that ascending triangle, the measured move of the triangle suggests that the market could go looking towards the $77.50 level as a target. I think we will go higher than that, but it makes a good initial target.

Underneath, I believe that there are plenty of people that would be willing to jump into the marketplace in order to take advantage of what is obviously an inflation play, as well as a reopening play, as we should continue to see demand pick up for the rest of the year. We are seeing economies around the world reopen and we had a slowdown in oil extraction during the pandemic itself. This has offered a bit of a “perfect storm” for buyers to continue to push this market to the upside. The market is likely to continue to find plenty of reasons to go higher, if for no other reason than the possibility of the US dollar falling. In fact, I have no interest in trying to get short of this market until we break down below the $65 level, which is nine dollars below where we are currently trading at. With this, I remain bullish, but recognize there is a lot of noise between here and the end of the run.