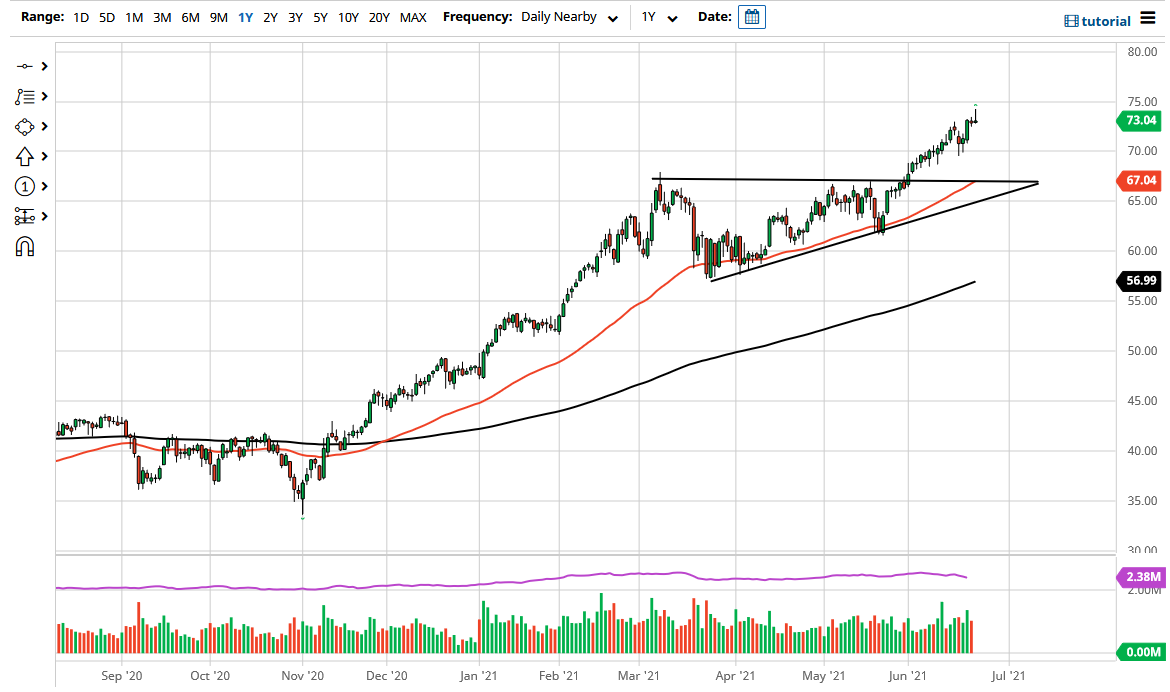

The West Texas Intermediate Crude Oil market initially rallied during the trading session on Wednesday but gave back the gains as we got close to the $75 level. The $75 level is a large, round, psychologically significant figure, and an area that will attract a certain amount of attention. Looking at this chart, you could make an argument for a shooting star as well, and that suggests that we will perhaps get a little bit of a pullback.

To the downside, the $70 level should offer a certain amount of support, as it is a large, round, psychologically significant figure and an area where we have seen support several times in the past. If we break down below there, the market could go looking towards the $67.50 level, where we also have the 50-day EMA reaching above the ascending triangle that had sent this market higher, and as a result, the “measured move” should be taken into account as well.

The “measured move” of the triangle suggests that we are going to go to the $77.50 level, but it would not surprise me at all if we go much higher. In the short term, maybe we are a little overbought, but I think at this point it is likely that we will continue to see a lot of bullish pressure over the longer term. I have no interest in shorting this market, due to the fact that it has been so strong for so long and we are paying close attention to the reopening trade around the world, Also, the fact that the overall oversupply of crude oil that was built up during the pandemic has been worked through will drive oil higher.

The alternate scenario is that we just turn around and break above the top of the shooting star, clearing the $75 level. That would be a very bullish sign, but at that point we could talk about the possibility of the market being a little overbought, and perhaps even overextended. Nonetheless, there is no scenario whatsoever in which I would be a seller of this market, as it is so strong from both a fundamental and technical point of view. I look at pullbacks as a possibility to pick up a bit of value in a very strong market.