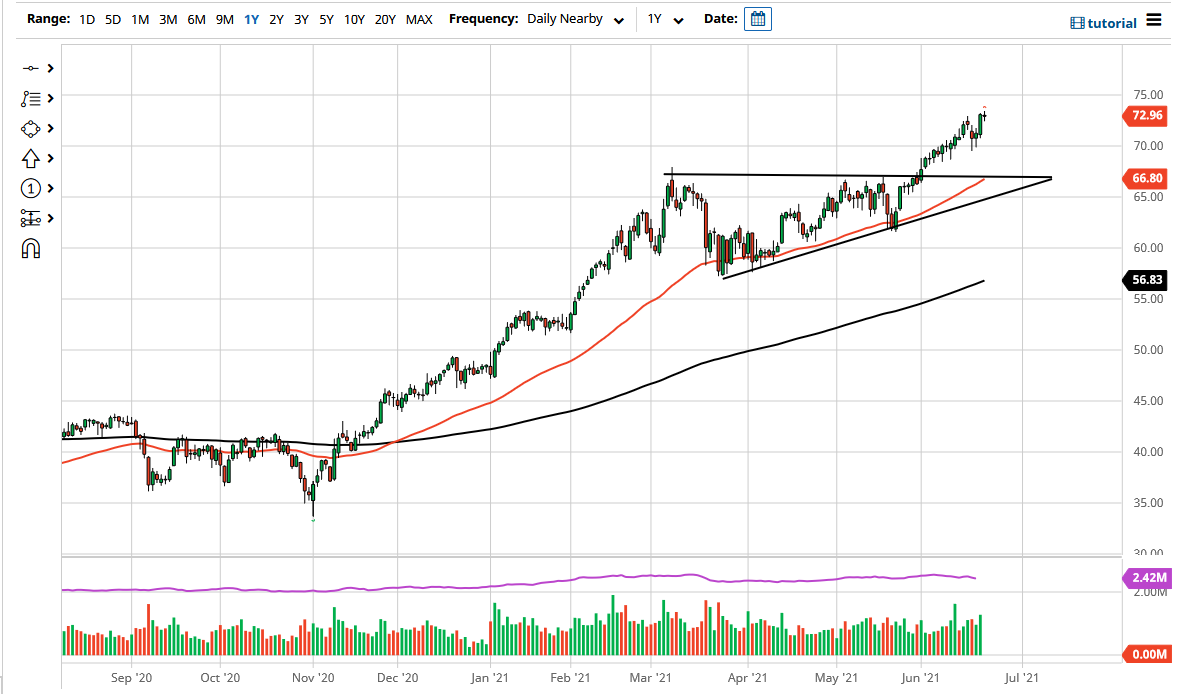

The West Texas Intermediate Crude Oil market did very little during the trading session on Tuesday, as the market is seemingly okay with the idea of the massive gains that had been part of the situation on Monday. The $73 level has caused a certain amount of resistance, but I think at this point in time it is a market that certainly cannot be sold, so I look at any pullbacks as an opportunity to pick up a bit of value going forward.

When you look at the ascending triangle that the market had broken out of, the market has a measured move of $77.50. The 50-day EMA is reaching towards the $67.50 level, which is the top of that triangle, so that is now what I consider to be the “floor in the market.” That is assuming that we can even break down below the $70 level, something that I do not necessarily think is going to be that easy to do. If we did, then I think even more value hunters would be attracted to this market.

Looking at the overall attitude of the market, it is difficult to imagine a scenario where you could be a seller. The market is continuing to see bullish behavior based upon the idea of the reopening trade driving demand drastically higher, and it makes sense that the pricing of crude oil would rally, so I look at this as an opportunity to get involved in a longer-term trade on the pullback.

The $75 level is an area that I think we will target relatively soon, and I also recognize it as a potential short-term resistance barrier. I look at this market as one that should be bought every time it dips, unless we break down below that ascending triangle. This is a market that continues to see headlines coming out of OPEC as well as major oil producers that suggest that oil prices are going to go much higher. In fact, Bank of America recently has called for $100 a barrel, which is a bit higher than I think it goes, but at the end of the day it just shows how attitudes are starting to shift again towards the upside.